Daily and hourly airport traffic is crucial for businesses related to airports, including airport authorities, airlines, retailers, ground handlers, rental car companies, and hotels. If you belong to any of these industries, utilizing daily airport traffic data can help you plan your operations, schedule your resources, forecast revenue, and plan budgets more accurately. Additionally, this data can help you target your marketing and promotional efforts more specifically, leading to more effective business strategies.

FlightBI collects and normalizes the airport passenger throughput data from US Transportation Security Administration (TSA). In addition, it has developed a product called Fligence TSA, which features a wide variety of data visualizations. FlightBI is currently offering a two-week, no-obligation trial of Fligence TSA for you to explore valuable insights from the airport traffic data.

This article summarizes US air traffic using the aforementioned tool, utilizing actual airport-level data as of March 4, 2023. Our analysis will examine trends in different segments of air travel, such as domestic versus international flights and leisure versus business travel. To learn more about the specific airports chosen to represent these markets, please refer to this article.

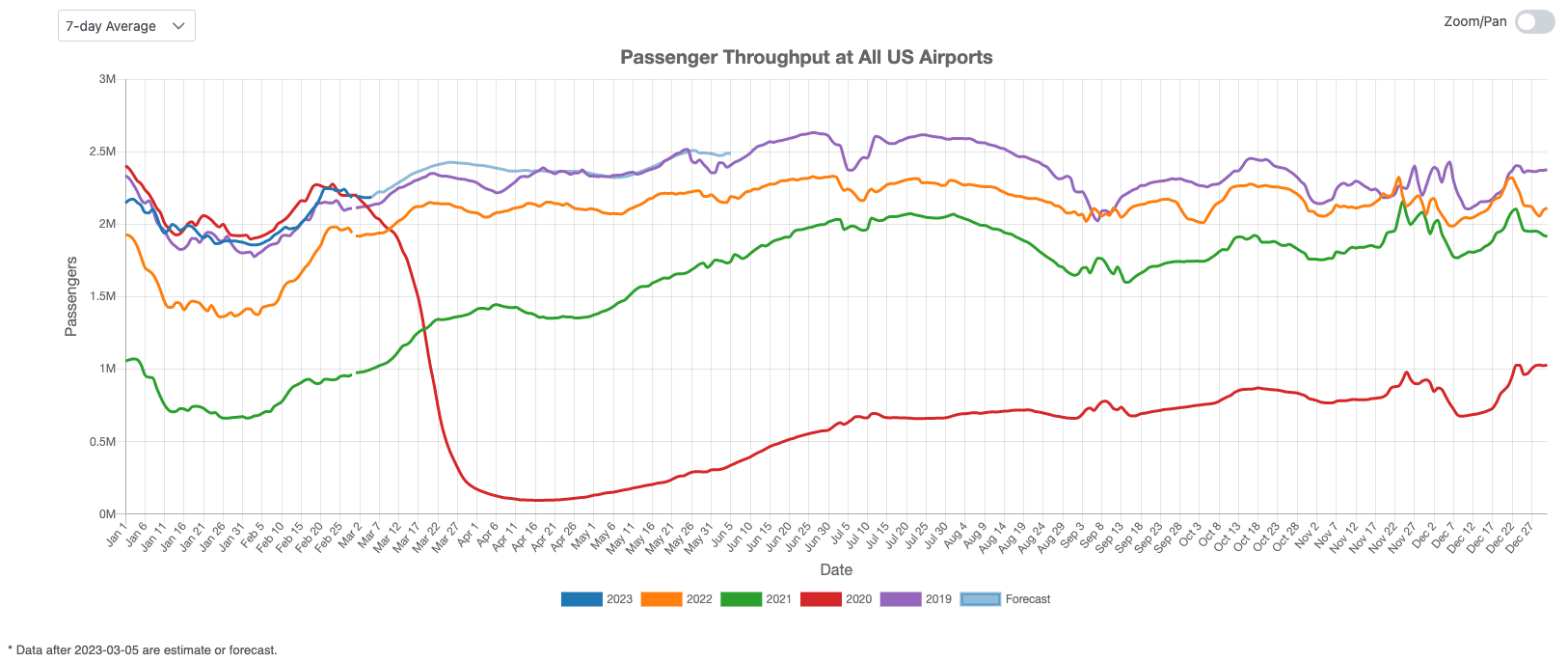

US Overall Airport Traffic Status

As illustrated in Figure 1, US air traffic has rebounded to pre-COVID levels. In line with previous years, there was a growth pickup in February compared to the end of January. Total volume is currently between 2019 and 2020 levels, and by the end of February, overall air traffic in the US had reached the historical peak achieved in 2020. Based on these trends, we anticipate that total traffic over the next three months will either remain consistent with or exceed the levels seen in 2019, which was the last full year of normal traffic prior to the COVID-19 pandemic.

Figure 1: US Overall Air Traffic Trend

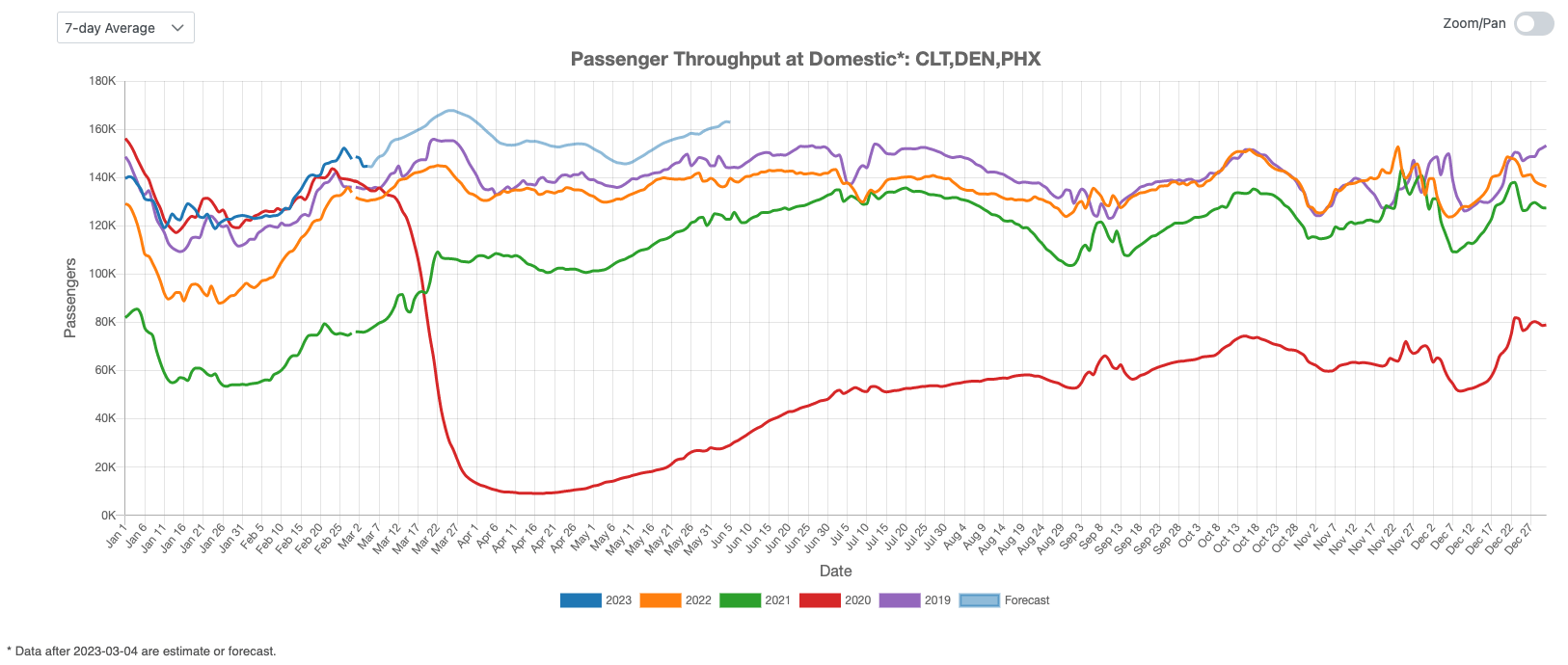

Domestic Airport Traffic Indicator

Figure 2 displays the US domestic air traffic indicator. As of February, US domestic air traffic has not only reached but exceeded the levels seen in 2020. Looking ahead, there is reason for optimism, as the next three months are typically characterized by increased air travel in the US domestic market during the spring season.

Figure 2: US Domestic Air Traffic Indicator

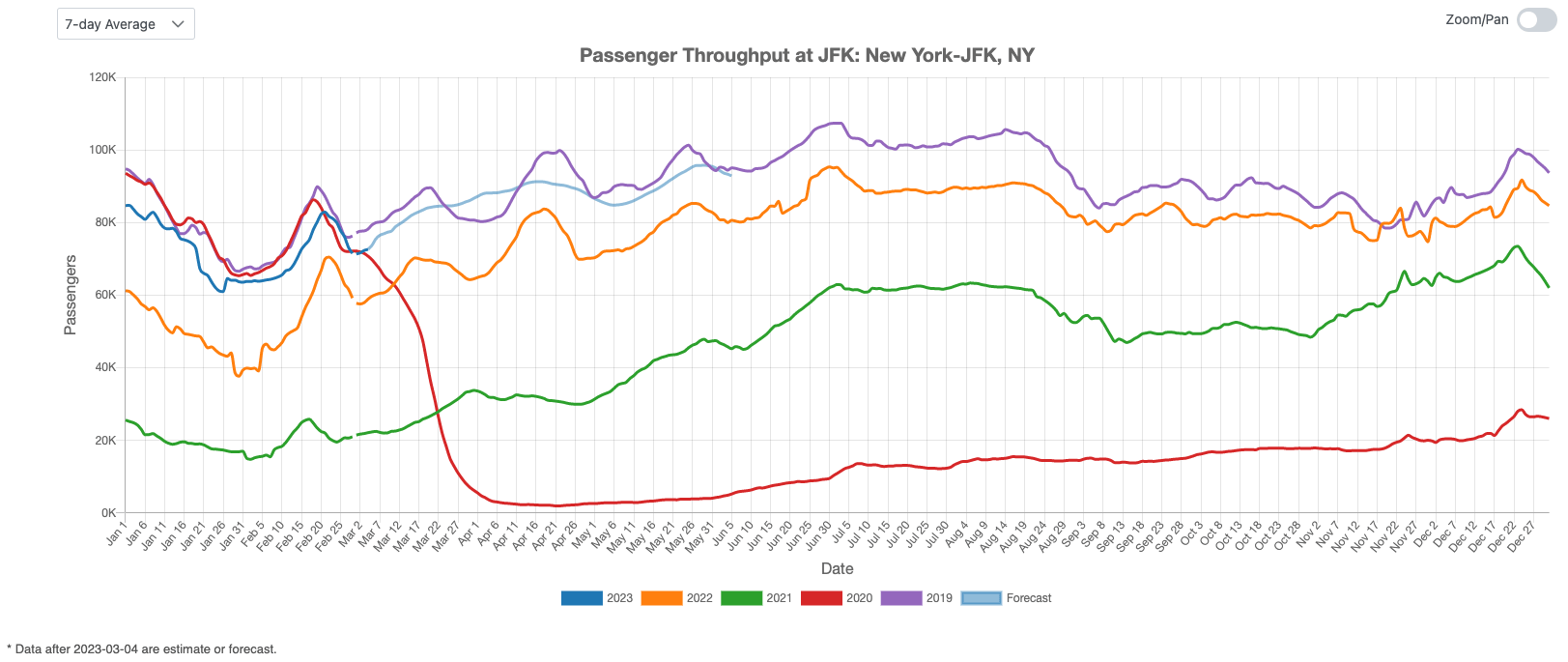

International Airport Traffic Indicator

Figure 3 depicts the US international traffic indicator. The 2023 curve for international traffic is steadily catching up, and we anticipate seeing stable growth in this segment over the next several months. However, it’s worth noting that the JFK outbound traffic in spring 2019 experienced some fluctuations, so it’s possible that the 2023 traffic curve may intersect with the 2019 curve multiple times in the coming months.

Figure 3: US International Air Traffic Indicator

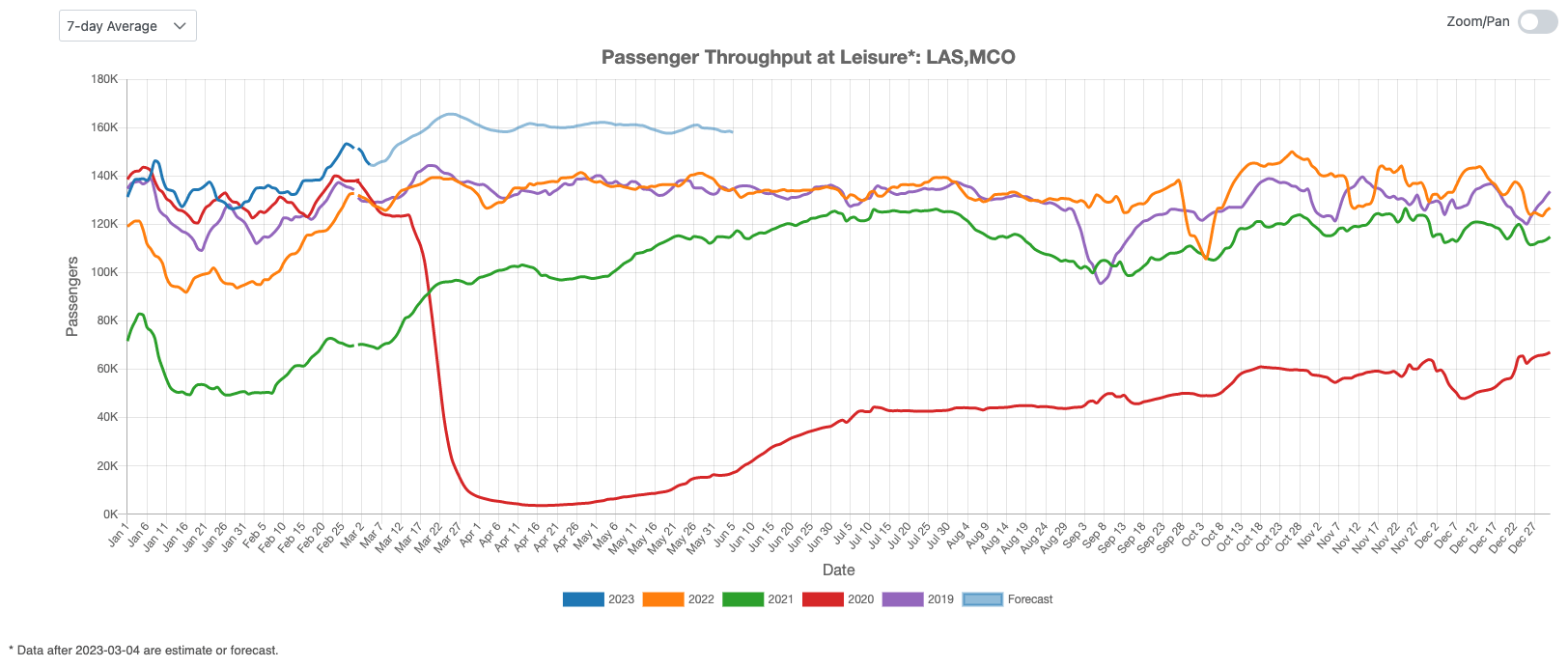

Leisure Air Traffic Indicator

Leisure air traffic has been a driving force behind the recovery of US air traffic following the COVID-19 outbreak. Although leisure traffic has been relatively stable in 2022, it is now gaining momentum once again. As illustrated in Figure 4, the 2023 leisure traffic curve has already surpassed the levels seen in 2020. Based on these trends, we expect leisure traffic to continue to soar in the coming months.

Figure 4: US Leisure Air Traffic Indicator

Business Air Traffic Indicator

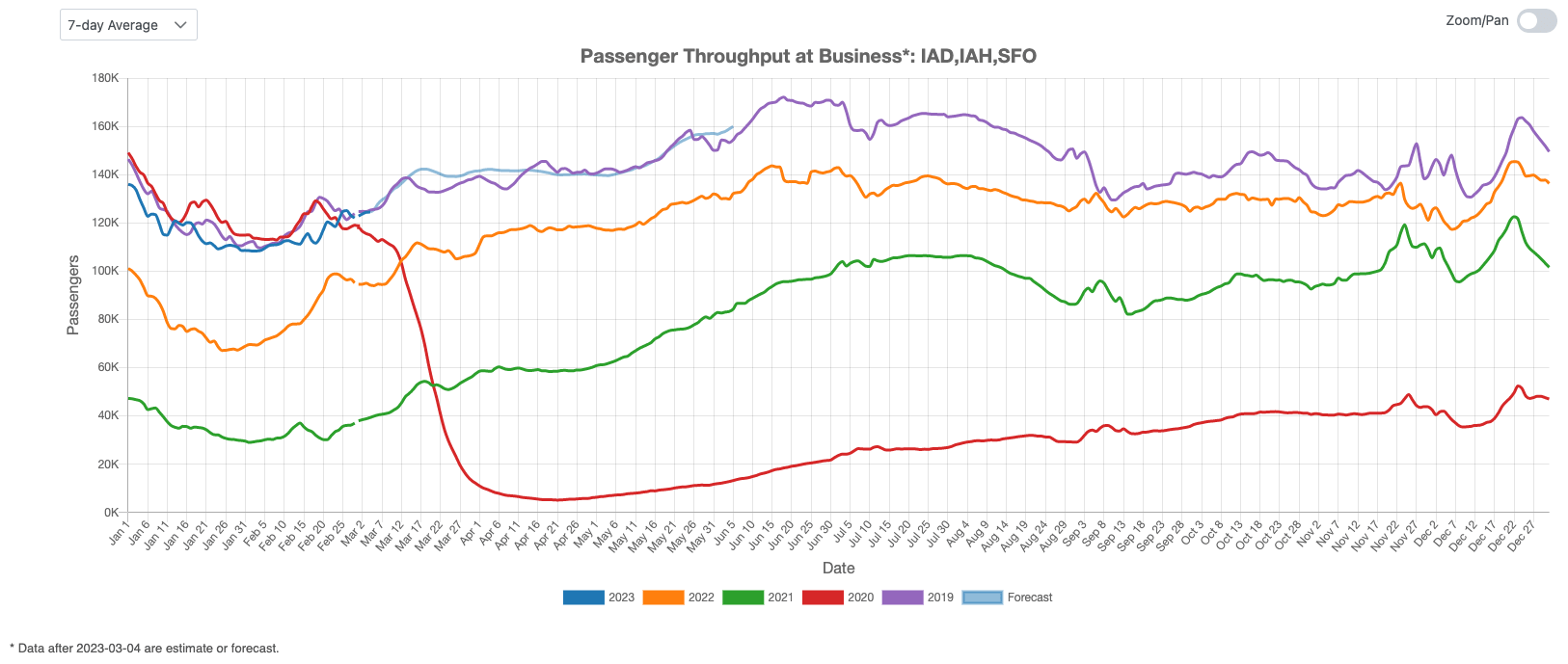

Turning to business traffic, Figure 5 indicates that the 2023 curve was below both 2019 and 2020 levels for most days in February. However, unlike previous years, the 2023 traffic did not experience a decline after Presidents Day. By the end of February, business traffic had also returned to pre-COVID levels. We anticipate that it will continue to climb towards a summer peak, in a manner consistent with a typical historical year.

Figure 5: US Business Air Traffic Indicator

In summary, February 2023 saw a healthy growth in US air traffic. Although the total airport traffic experienced a slight drop after Presidents’ Day, it remained relatively stable. The domestic and leisure markets continue to outperform the international and business markets, but the latter are also showing signs of growth.