Introduction

The US commercial air market is improving. Domestic traffic recovered faster than international traffic. And leisure travel spearheaded the recovery. But that’s not enough because airlines generate profit primarily from passengers paying first class and business class fares. Only when business trips and international travel come back to the pre-crisis level, we can say that the industry resumes its energy.

The most timely available air traffic indicator is the airport passenger throughput data collected by TSA (Transportation Security Administration). TSA counts people going through the security checkpoints. From those numbers, we don’t know if a passenger is for a domestic trip or an international trip. Neither do we know if that passenger pays a premium fare or an economy fare. However, by analyzing the T-100 statistics and DB1B ticket samples in 2019, we can tell which airports have more international versus domestic traffic and which airports have relatively more passengers paying premium fares.

Airport Selection

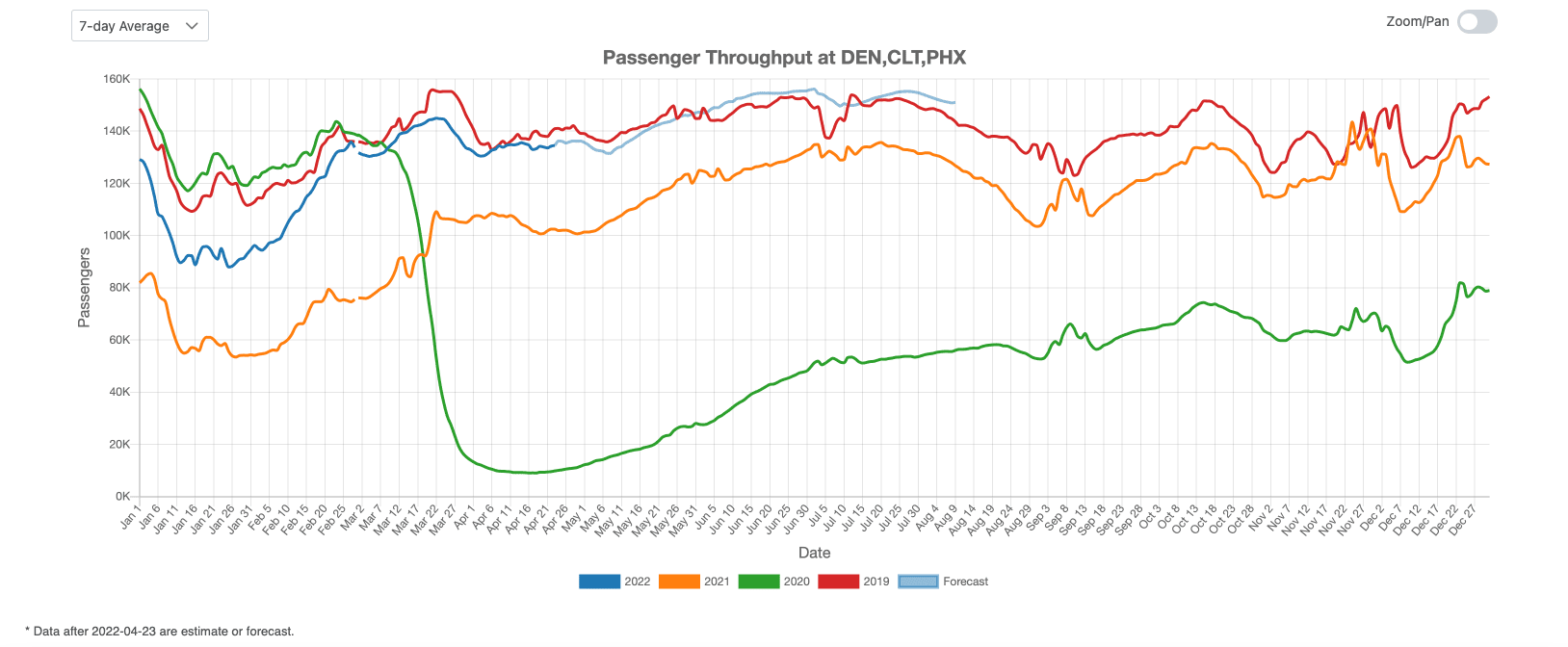

Among all large US airports with above 20 million outbound passengers in 2019, DEN (Denver), CLT (Charlotte), and PHX (Phoenix) have the largest percent of passengers traveling domestically. In 2019, 95% of passengers from DEN, 93% from CLT, and 95% from PHX are for domestic trips. Therefore, we can use those three airports as a wind vane of domestic traffic trends.

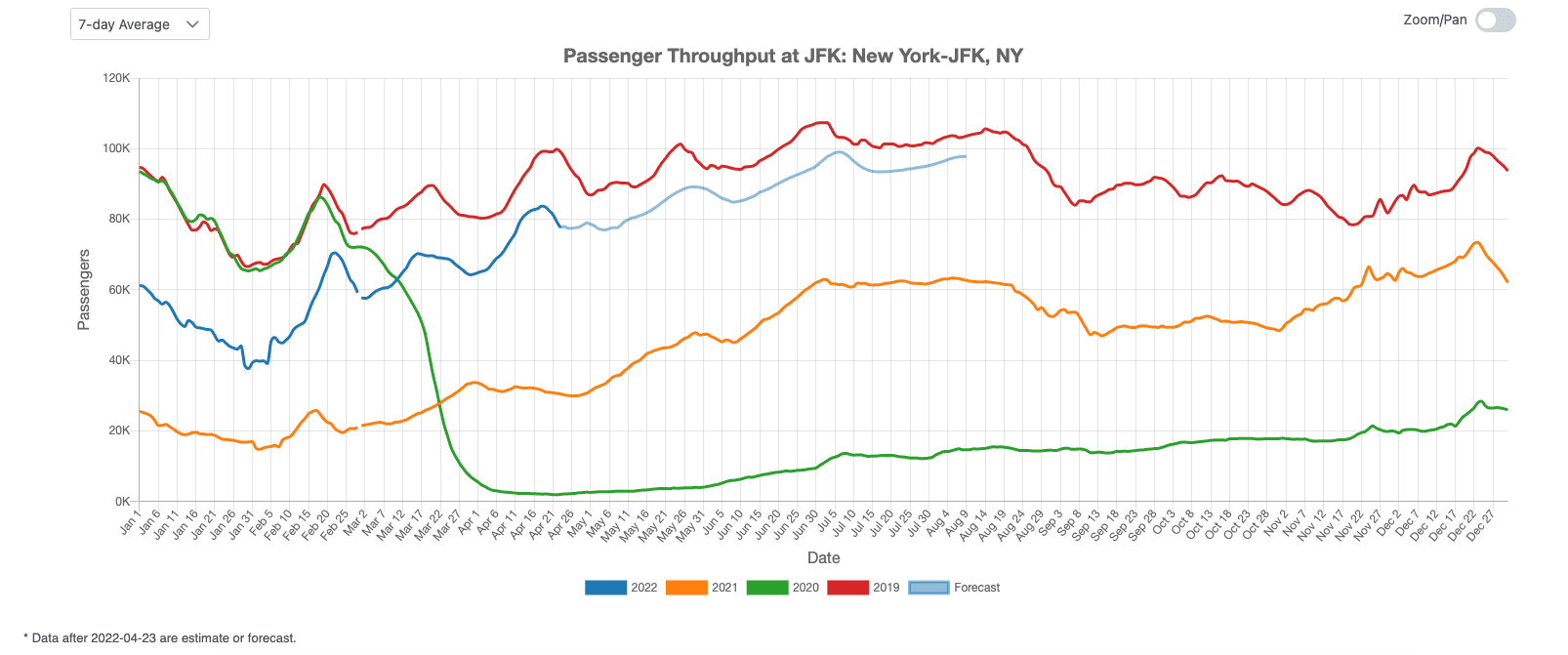

On the opposite, JFK (New York) and MIA (Miami) are two airports with the largest percent of passengers for international trips. In 2019, 55% of passengers from JFK and 50% of passengers from MIA are on international flights, according to the T100 statistics. However, Miami is also a hot tourist place, thanks to its warm weather and beautiful beaches. To avoid mixing the growth drivers, we only pick JFK as an indicator for international air traffic.

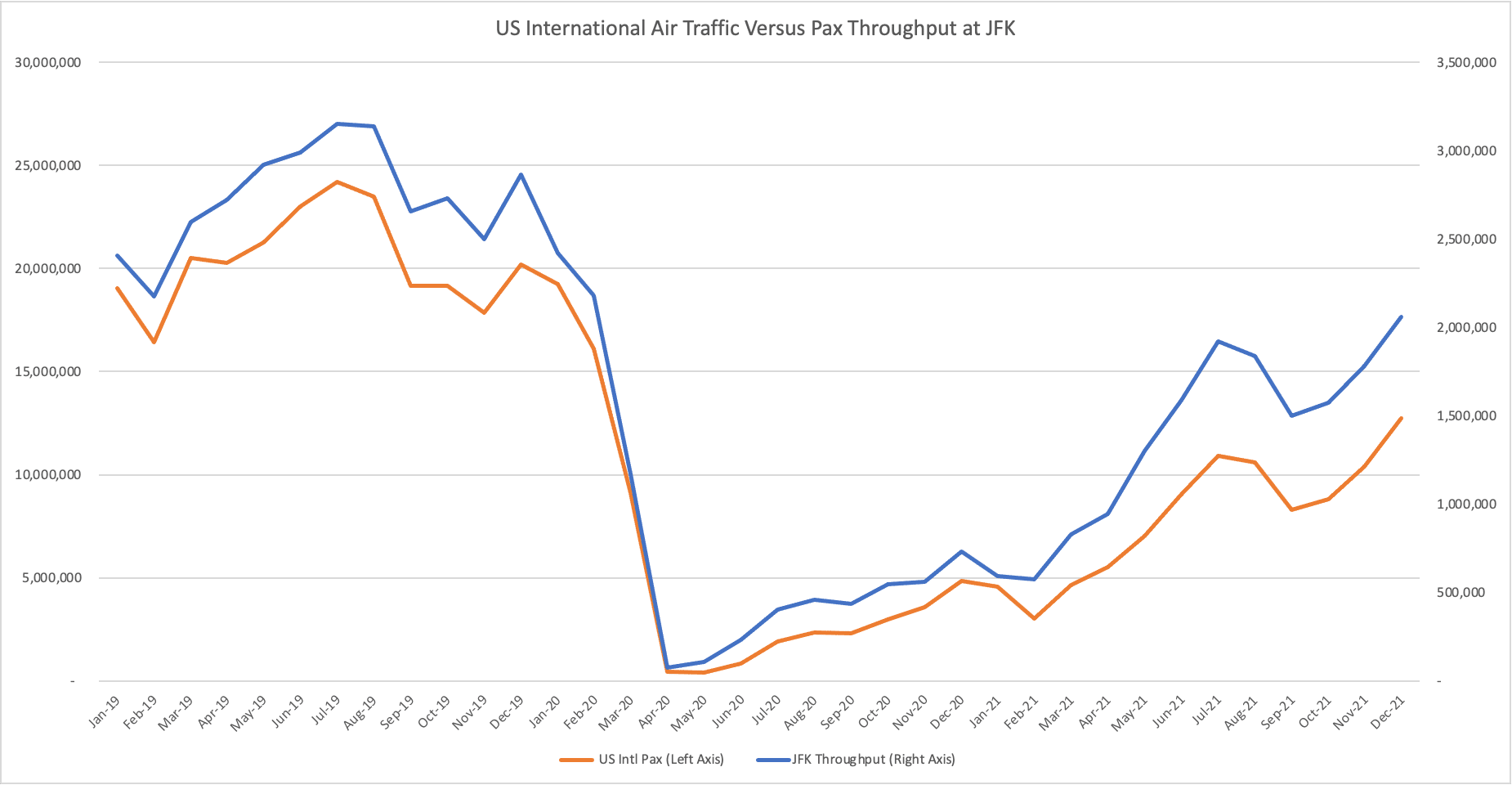

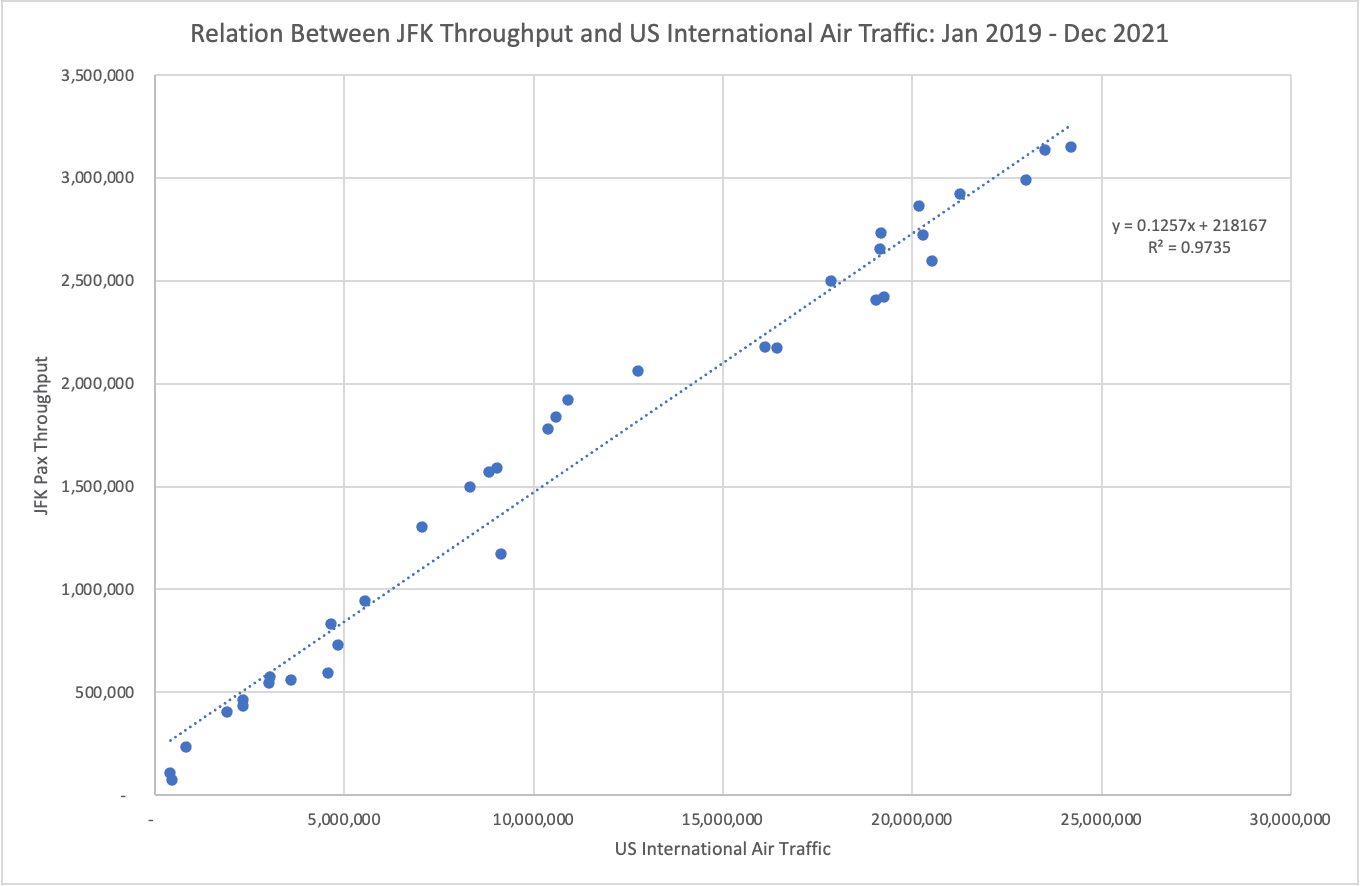

You may argue that one airport cannot represent all US international traffic and New York is also a popular tourist place. That’s true. The most accurate international traffic numbers can be found in the T100 statistics. But T100 reports have several month lags. When we compare the historical trend of international traffic with JFK passenger throughput, we found a very high correlation. Therefore, JFK is good to be treated as a wind vane for international traffic.

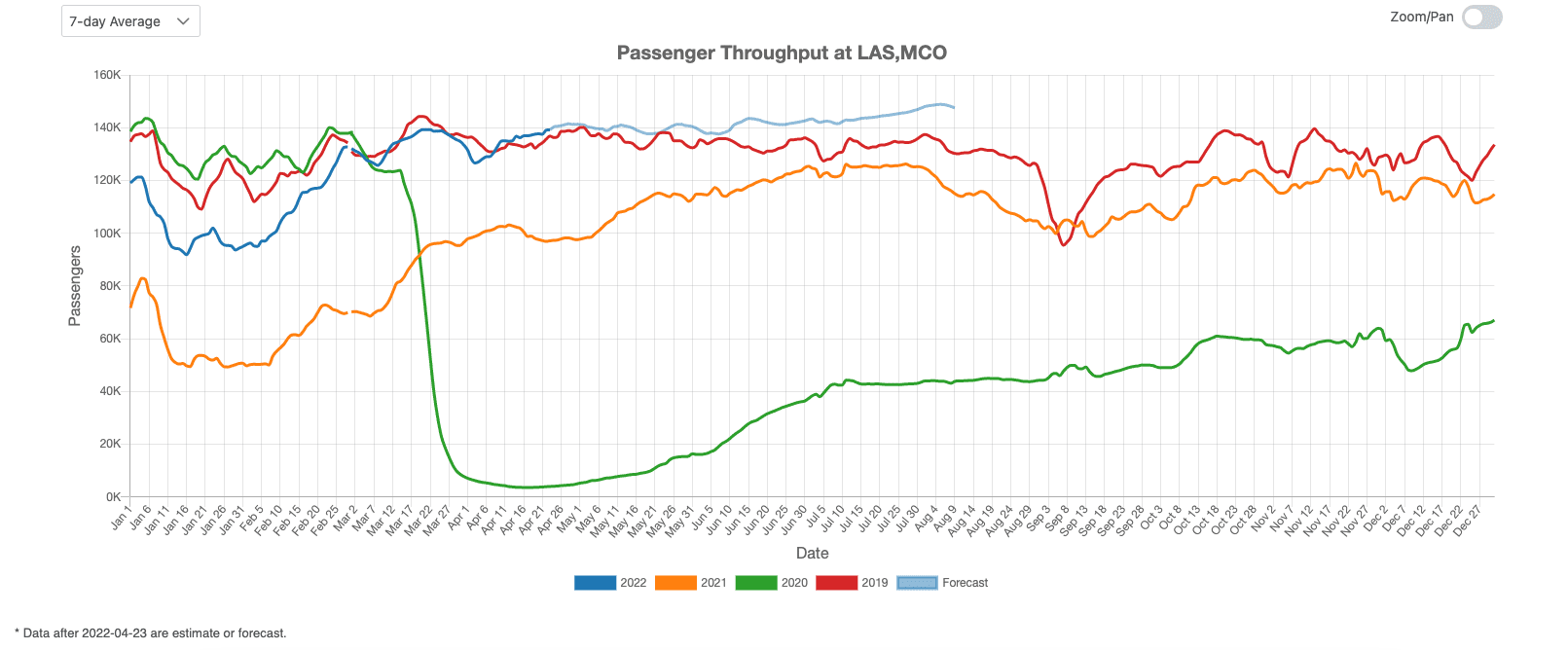

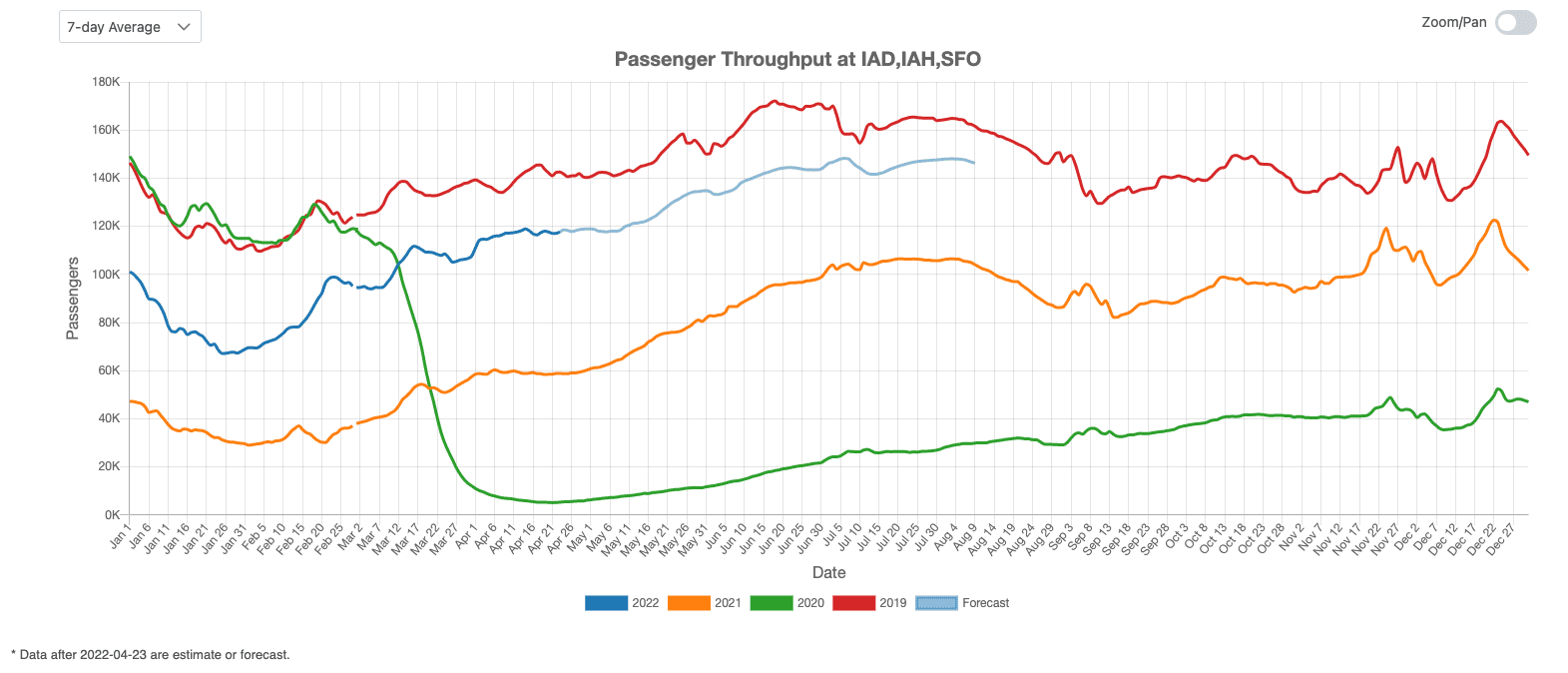

For leisure travel, we pick up MCO (Orlando) and LAS (Las Vegas) because most travelers to/from those airports are for amusement parks and casinos. For a business trip, we choose SFO (San Francisco), IAH (Houston), and IAD (Washington). 6.5%, 6.5%, and 7.3% of passengers from those airports, respectively, paid premium fares. Those are the highest ratios among all large US airports. After all, many trips to/from those airports are related to Finance, Oil & Gas, and Government.

With those wind vanes, we can look at the recovery status of the US commercial air industry!

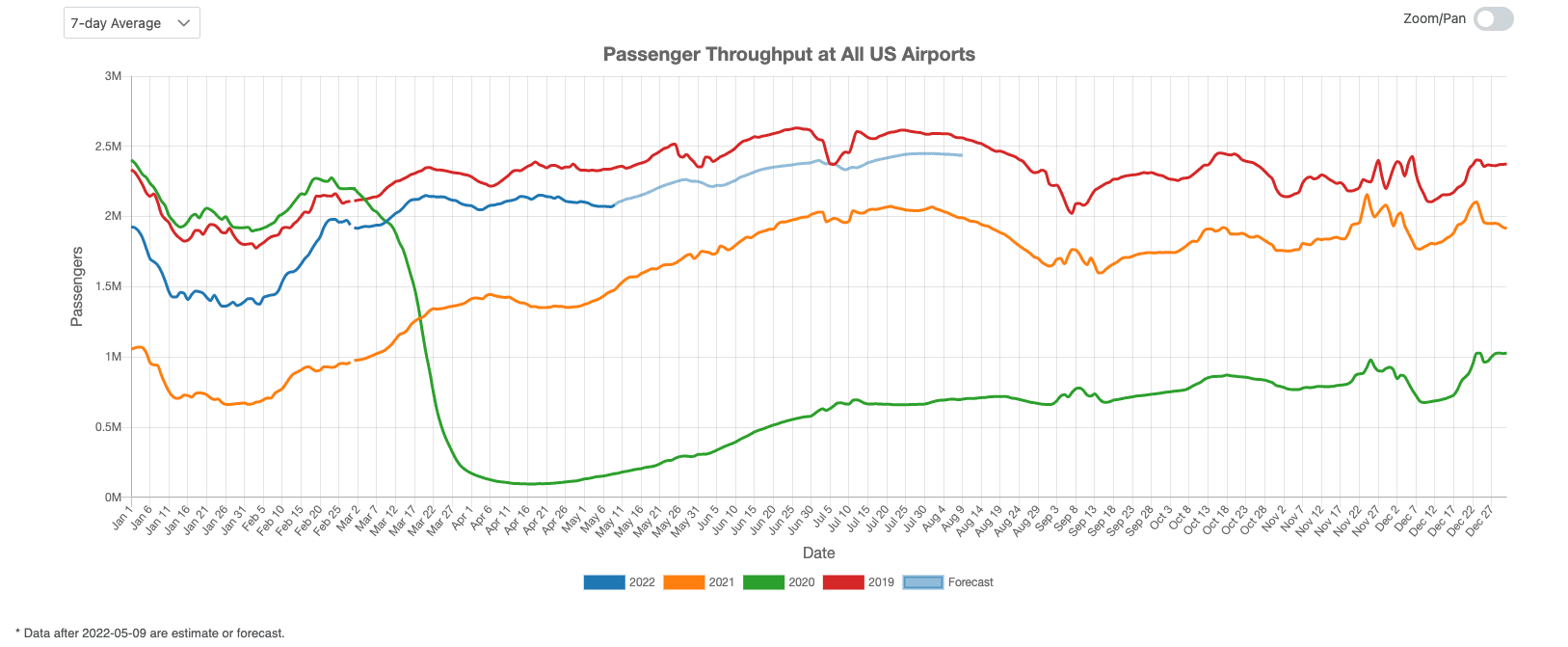

U.S. Overall Air Traffic Status

At the U.S. overall level, the traffic gap between 2022 and 2019 has increased from around 7-8% at the beginning of the month to about 10% at the end of the month. The average airport throughput has well stood at over 2 million people per day. The summer peak season is coming. We optimistically predict the recovery is ongoing and the gap may be shrunk in the summer.

Domestic Air Traffic Status

Domestic air traffic has almost recovered to the 2019 level, but the growth in Apr. 2022 is not as strong as that in Apr. 2019. As a result, we see a narrow gap at the end of Apr. at three typical domestic airports – DEN (Denver), CLT (Charlotte), and PHX (Phoenix). Airlines are confident in the summary traffic. More capacity has been scheduled for the summer. Therefore, we also expect the domestic traffic will catch up to the pre-crisis level by this summer.

International Air Traffic Status

International air traffic lags behind because many Asia countries have not opened their borders. At JFK, the pax throughput went through a peak around Apr. 20. The gap between 2022 and 2019 decreased in the middle of Apr and then increased slightly. We expect the situation to improve further this summer.

Leisure Air Traffic Status

The leisure air traffic, represented by LAS (Las Vegas) and MCO (Orlando), has already reached the 2019 level in March. A gap was seen at the beginning of Apr. but was quickly filled. We think that the leisure air traffic will keep above the pre-crisis level in the near future.

Business Air Traffic Status

Regarding the business air traffic, represented by SFO (San Francisco), IAH (Houston), and IAD. (Washington), the gap between 2022 and 2019 was maintained between 15-20%. We think this trend will last until the summer and will be improved slightly later.

Summary

In this article, we discussed the US air traffic recovery using typical airports for domestic traffic, international traffic, leisure traffic, and business traffic. In April, the US air traffic recovery is still on track. We expect more catch-up to happen this summer!