Daily and hourly airport traffic is crucial for businesses related to airports, including airport authorities, airlines, retailers, ground handlers, rental car companies, and hotels. If you belong to any of these industries, utilizing daily airport traffic data can help you plan your operations, schedule your resources, forecast revenue, and plan budgets more accurately. Additionally, this data can help you target your marketing and promotional efforts more specifically, leading to more effective business strategies.

FlightBI collects and normalizes the airport passenger throughput data from US Transportation Security Administration (TSA). In addition, it has developed a product called Fligence TSA, which features a wide variety of data visualizations. FlightBI is currently offering a two-week, no-obligation trial of Fligence TSA for you to explore valuable insights from the airport traffic data.

This article summarizes US air traffic using the aforementioned tool, utilizing actual airport-level data as of Dec. 30th, 2023. Our analysis will examine trends in different segments of air travel, such as domestic versus international flights and leisure versus business travel. To learn more about the specific airports chosen to represent these markets, please refer to this article.

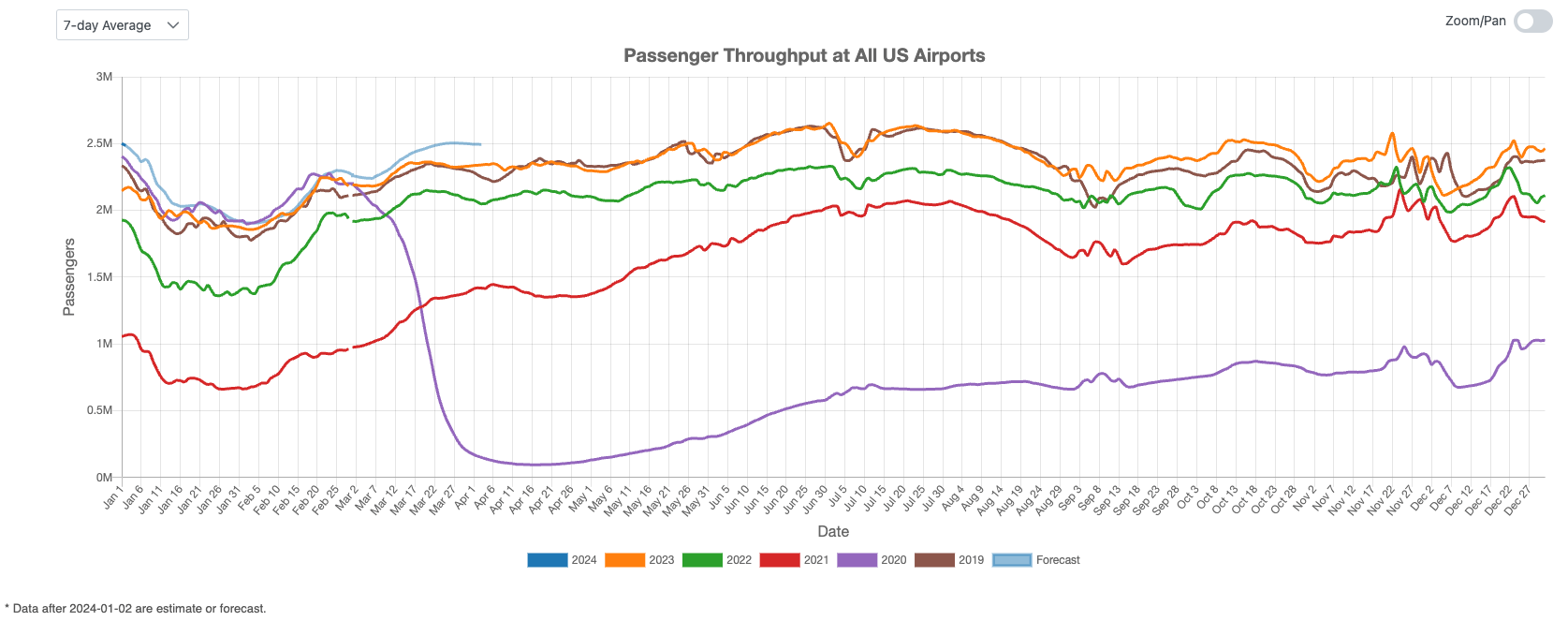

US Overall Airport Traffic Status

Figure 1 demonstrates that for most of the year, U.S. air traffic exceeded pre-pandemic (2019) levels. However, there was a noticeable dip in traffic volume at the start of December 2023, followed by a recovery towards the year’s end. Looking ahead, it is anticipated that air traffic in 2024 will exhibit a gradual increase compared to 2023.

Figure 1: US Overall Air Traffic Trend

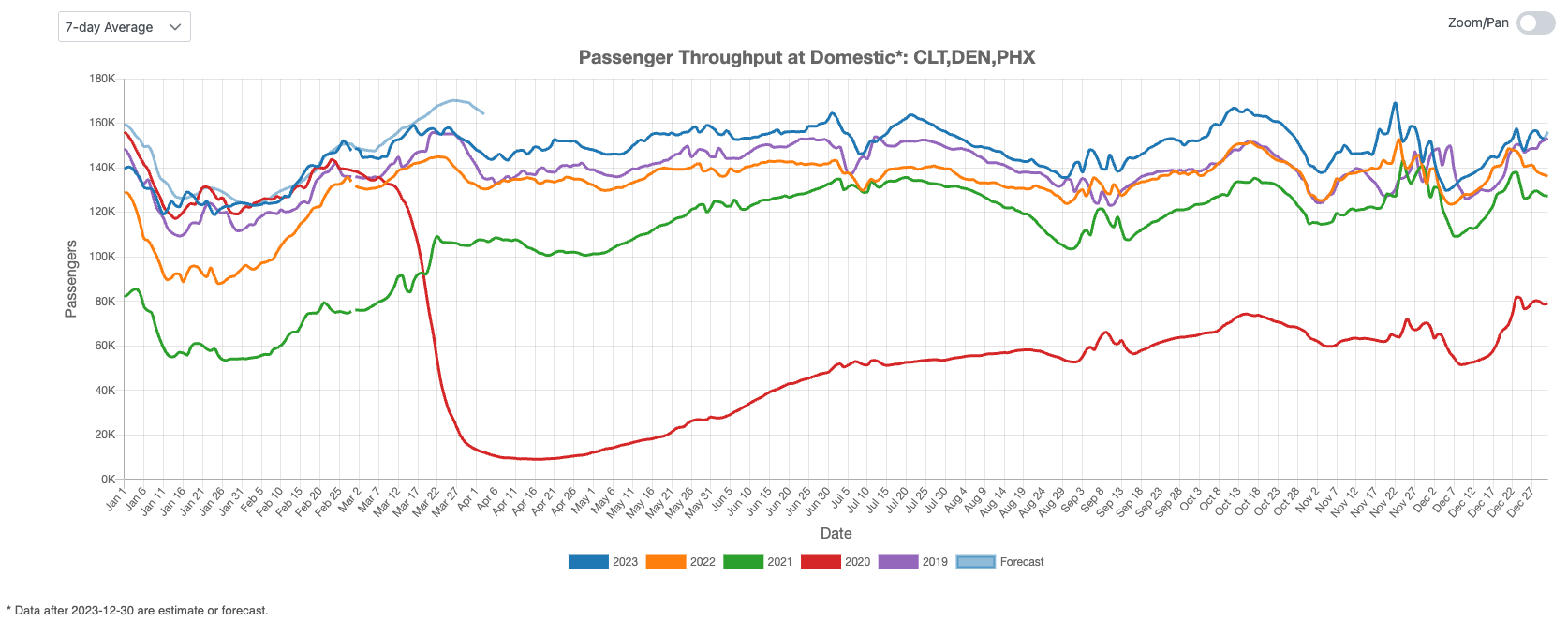

Domestic Airport Traffic Indicator

Figure 2 highlights the pattern in U.S. domestic air travel, revealing a notable peak at the outset of December 2019. In subsequent years, a consistent trend emerged: a modest start in December followed by a gradual increase towards year’s end. This pattern persisted in December 2023, culminating in a record high surpassing all previous years. This robust performance sets a promising foundation for the first quarter of 2024, where we anticipate domestic air traffic to consistently exceed the levels observed in prior years.

Figure 2: US Domestic Air Traffic Indicator

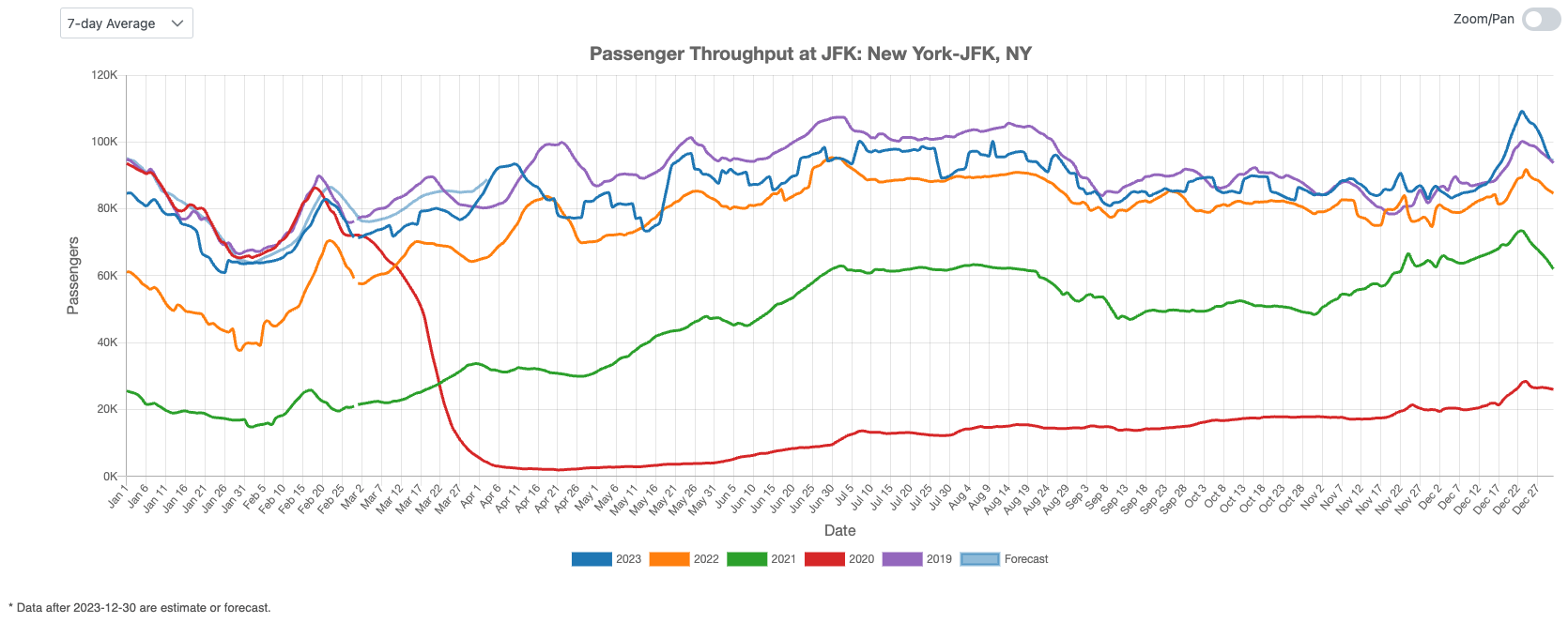

International Airport Traffic Indicator

Figure 3 presents the U.S. international air traffic index, showcasing a notable peak prior to Christmas Day in 2023. Following this, there was a decline in traffic in the final week of December. Given the current challenges with supply chain constraints and regional instability, it is unlikely that U.S. international air traffic will surpass the pre-COVID historical highs in the first quarter of 2024.

Figure 3: US International Air Traffic Indicator

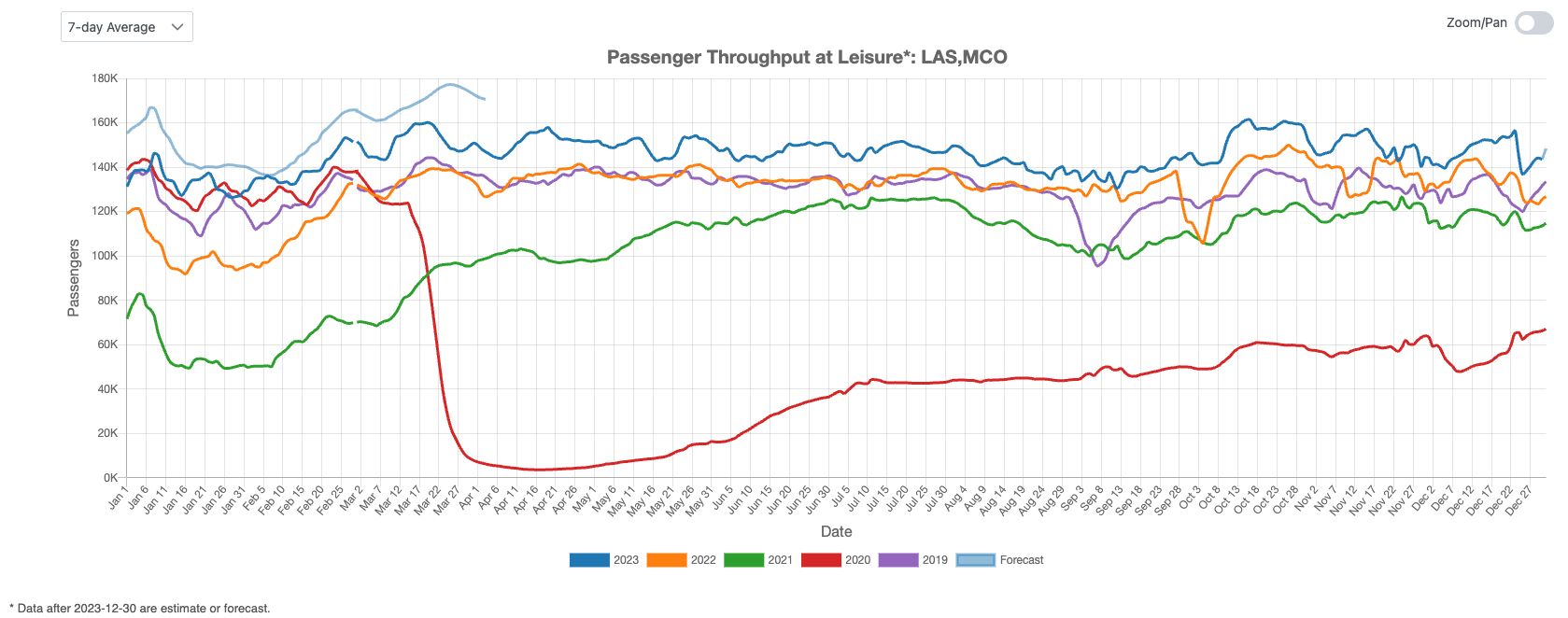

Leisure Air Traffic Indicator

Figure 4 illustrates a significant resurgence in leisure air travel beginning in October 2023, which continued through the end of the year. Based on this trend, we anticipate a further boom in this sector during the first quarter of 2024.

Figure 4: US Leisure Air Traffic Indicator

Business Air Traffic Indicator

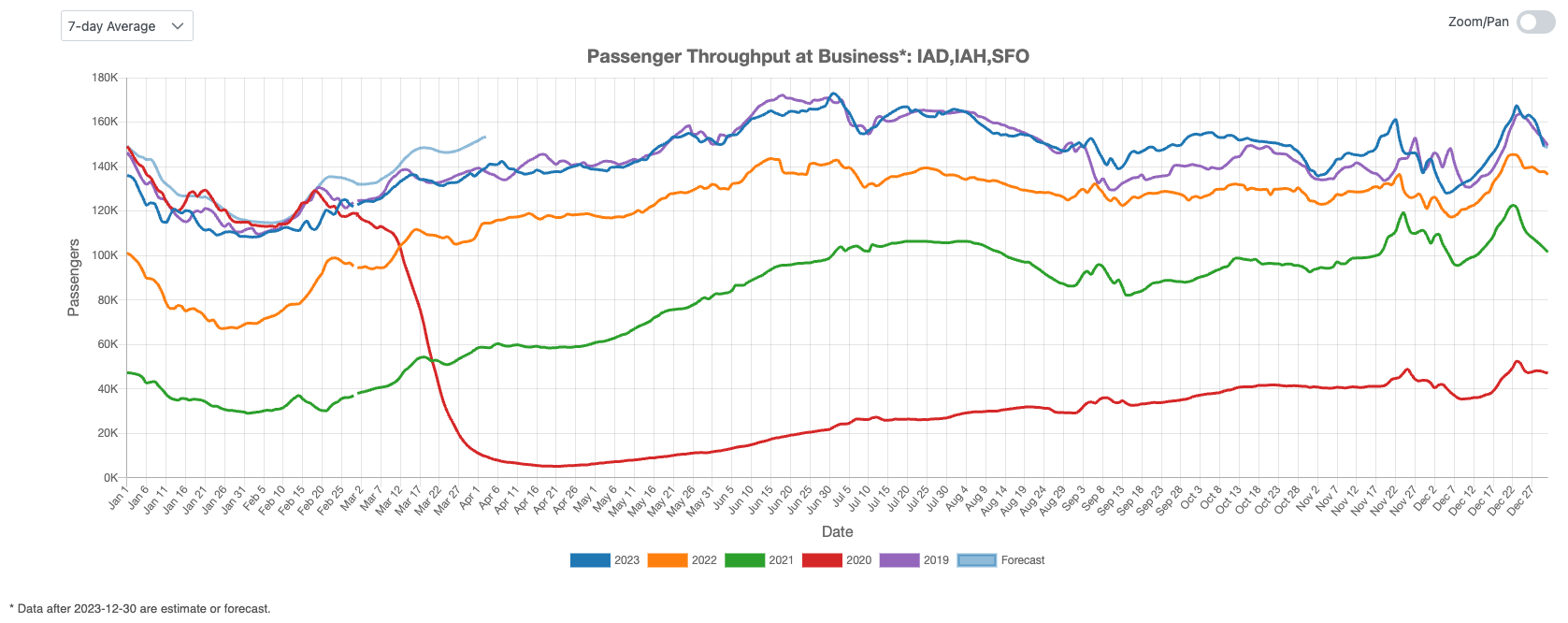

The business travel segment also demonstrates robust performance, as depicted in Figure 5. The 2023 business travel index curve, after initially lagging in early December 2023, successfully aligned with the 2019 curve. Looking ahead to the new quarter, the disparity between the 2024 figures and pre-COVID levels is expected to remain minimal. Notably, in March 2024, business air travel is projected to accelerate.

Figure 5: US Business Air Traffic Indicator

In the U.S. air travel market, domestic flights showed a consistent year-end upward trend, culminating in a record high in December 2023. International traffic peaked before Christmas 2023 but is constrained by external factors, making a surpass of pre-COVID levels unlikely in early 2024. Leisure travel experienced a resurgence from October 2023, with expectations of continued growth into early 2024. Business travel, after a brief dip in early December 2023, aligned with 2019 levels and is anticipated to reach new heights by March 2024.