US airfare kept climbing up in April 2022! The preliminary true O&D level data released by FlightBI today shows that pax volume was flat, but the average fare increased 22% from March 2022 to April 2022.

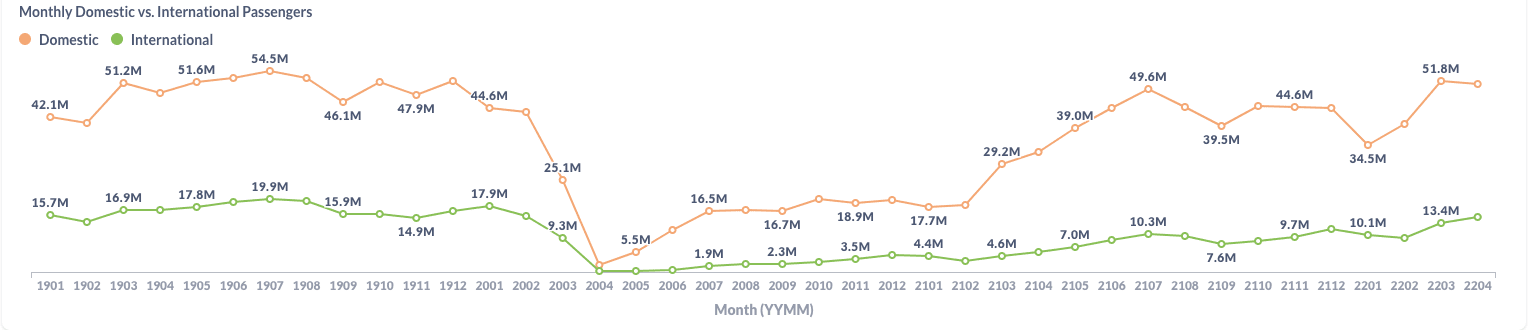

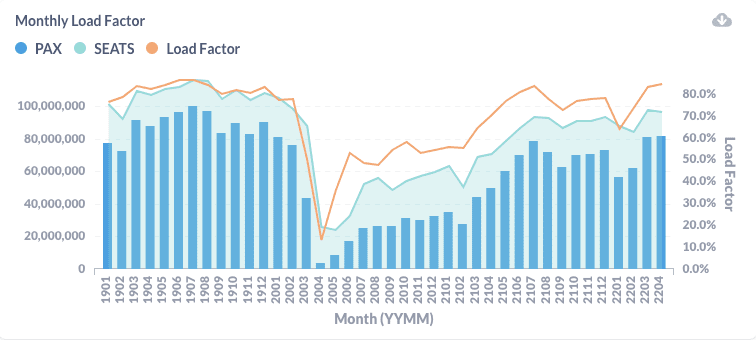

Volume Trend

US domestic traffic by true O&D slowed down a little bit from 51.8 million passengers in March to 51.0 million in April. This value is higher than the pre-pandemic level of 48.7 million in April 2019. The US international traffic increased from 13.4 million in March to 15.1 million in April, a continuous improvement from the COVID-19 hit.

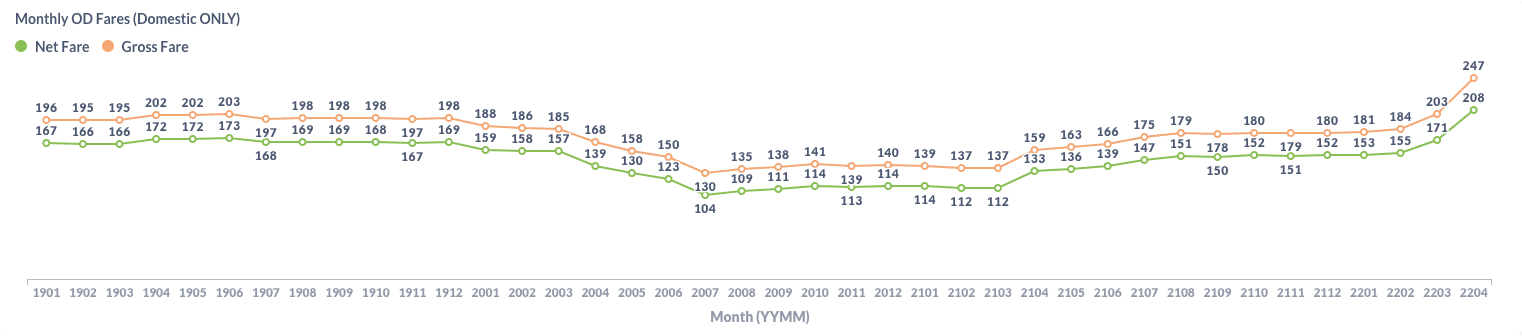

Fare Trend

Both gross fare and net fare increased significantly. The domestic average gross fare increased from $203 in March to $247 in April by 22%. Similarly, the average net fare grew from $171 to $208.

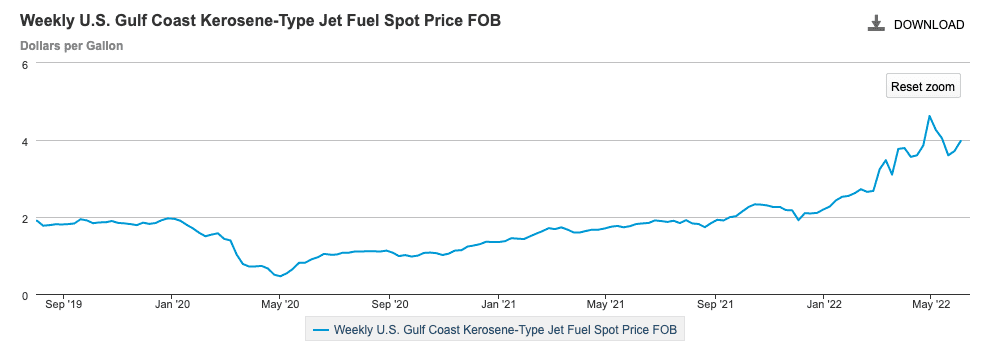

The fare increase is partly driven by the tightening capacity and partly driven by the inflation of jet fuel prices, as shown in the chart below provided by EIA. Unfortunately, the average airfare in May escalated further. Not good news for air travelers!

Load Factor Trend

In April, US airlines reduced capacity due to a shortage of pilots and operational staff. The average load factor increased further because overall traffic in April is also slightly higher than that in March. On average, the load factor of US carriers has increased from 83.2% in March to 84.6% in March, which is higher than the load factor of 82.1% in April 2019.

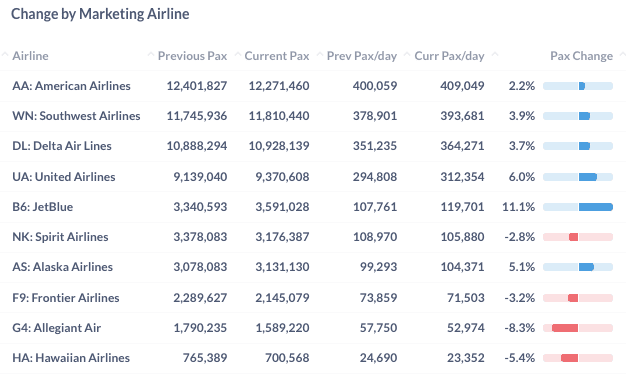

Month Over Month Comparison

The passenger traffic growth by airlines is a mixed picture in April. JetBlue led the traffic growth with an 11.1% change. All big four – American, Southwest, Delta, and United – carried more passengers per day, but low-cost carriers Spirit and Frontier had less daily traffic than the previous month. The leisure airline Allegiant slowed down the most with a -8.3% change.

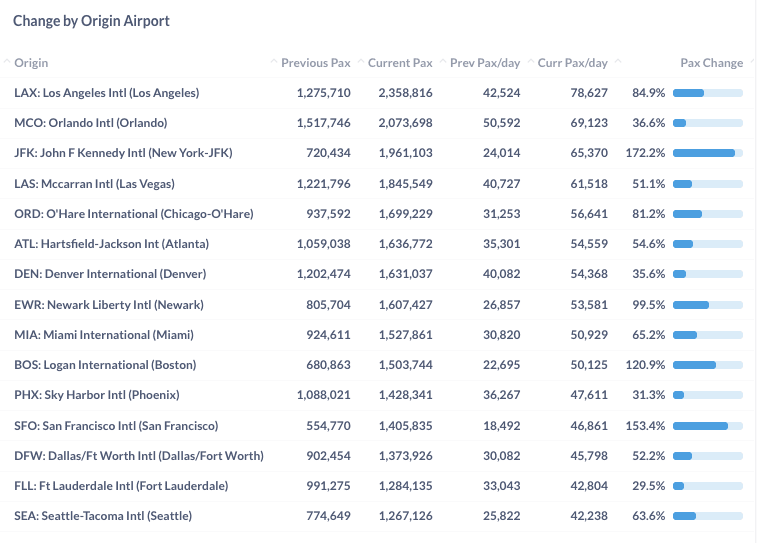

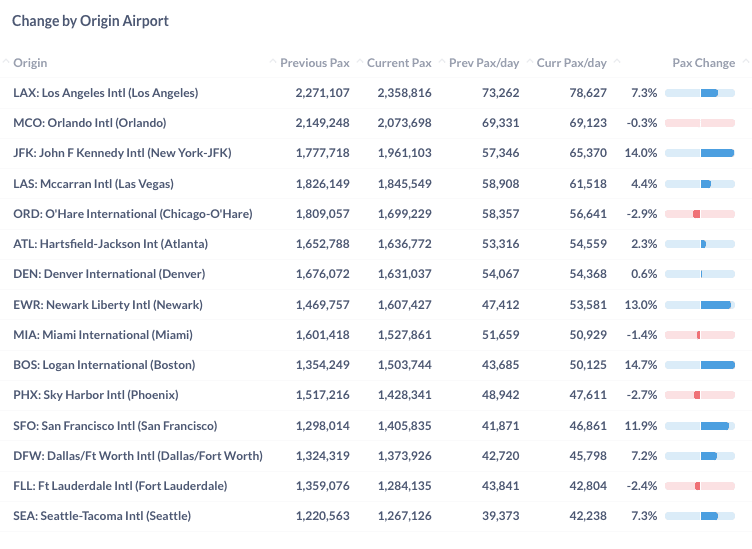

Among the top 15 airports, BOS(Boston), JFK (New York), and EWR (New York) grew traffic by 14.7%, 14.0%, and 13.0%, respectively, from March. Although the growth rates are not as high as those in March, more of those are driven by international traffic. In April, some top airports such as ORD(Chicago), PHX(Phoenix), and FLL(Fort Lauderdale) had negative growth, reflecting a slight decrease in domestic traffic because of seasonality.

Year Over Year Comparison

Compared to the same month last year, all airlines had a fantastic performance. Hawaiian, United, and Delta increased volume by more than 87%. The low-cost carriers Spirit and Frontier increased traffic by 33% and 38%. Those growth rates are not as high as other US airlines, but that’s because Spirit and Frontier rebounded earlier from the pandemic than others.

Three airports with the highest traffic growth from last year are JFK (New York), SFO (San Francisco), and BOS (Boston). All those airports have a good portion of international traffic and business travelers. That’s what airlines want because they usually have higher profit margins from those passengers.