As Super Bowl LVIII approaches this weekend, the anticipation is not just building for the fans and players but also for the private aviation industry, particularly for Part 135 operators. Reflecting on the significant impact of Super Bowl LVII held in Phoenix, Arizona, in 2023, there are valuable insights and strategies that can be drawn to prepare for the expected surge in private flights.

By comparing the volume of business aviation (BizAv) flights from the week of February 6 to February 12 in 2023—a week leading up to Super Bowl LVII in Phoenix—with the same period in 2022, when Phoenix hosted no such event, we can discern the origin cities of private flying clientele and understand the event’s draw. The following eight airports are used to capture all private flights to Phoenix:

- KGEU: Glendale Municipal Airport

- KGYR: Phoenix Goodyear Airport

- KDVT: Phoenix Deer Valley

- KPHX: Phoenix Sky Harbor

- KSDL: Scottsdale Airport

- KIWA: Phoenix-Mesa Gateway Airport

- KCHD: Chandler Municipal Airport

- KFFZ: Falcon Field Airport

The Private Flight Surge Phenomenon

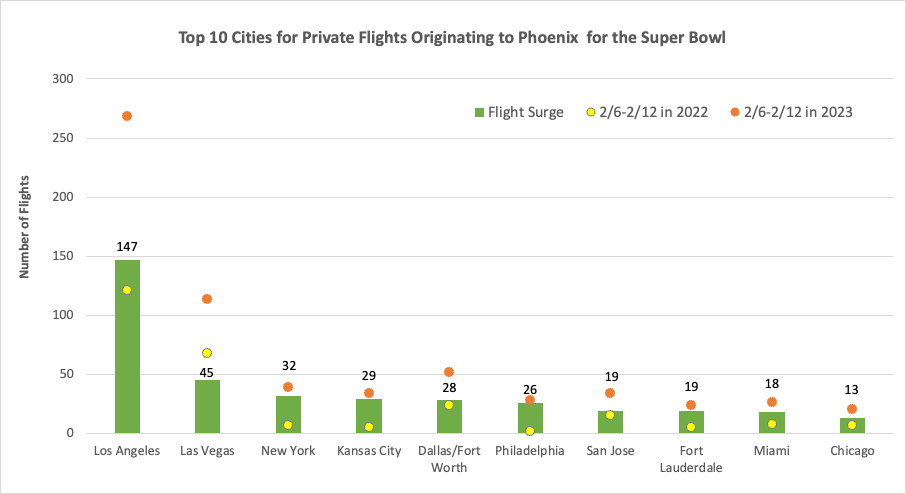

Super Bowl LVII, held on February 12, 2023, in Phoenix, Arizona, acted as a beacon for private flyers. The week preceding the event saw a marked increase in business aviation flights, as shown in Figure 1. The data clearly indicates the cities where fans and corporates chose to embark on their exclusive journeys to the game. This surge wasn’t just a measure of enthusiasm but also a map of the most active markets for private aviation during major events.

Top 10 Origin Cities of Private Flights for Super Bowl

The data from 2023 revealed that Los Angeles was the epicenter of the Super Bowl flight surge, with an additional 147 flights compared to the previous non-event year. Multiple airports, including Van Nuys (KVNY), Los Angeles (KLAX), Santa Ana (KSNA), and Burbank (KBUR), contributed to the traffic from Los Angeles. This significant increase was followed by other cities in descending order of flight surges: Las Vegas, New York, Kansas City, Dallas/Fort Worth, Philadelphia, San Jose, Fort Lauderdale, Miami, and Chicago. Each of these cities contributed to the heightened demand for flights, painting a clear picture of where the demand for private Super Bowl travel was most concentrated.

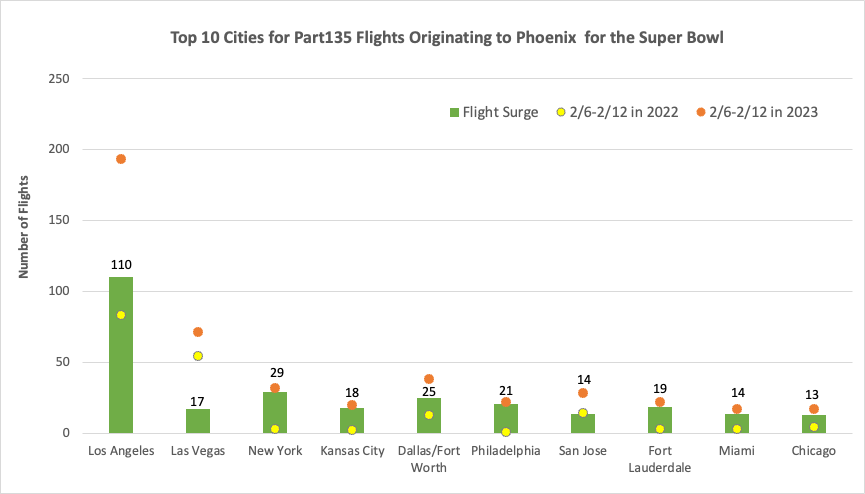

Total Private Flying vs. Part 135 Operations

The differentiation between total private flights and those specifically under Part 135 operation is critical. While the total numbers provide an overview, the Part 135 data reflects a targeted market segment. For instance, Los Angeles not only topped total private flights but also saw the highest Part 135 operator surge with an additional 110 flights, as shown in Figure 2. New York, a distant second in the Part 135 category, still showed a remarkable growth, indicating the city’s high demand for charter services. In contrast, Las Vegas has less charter demand than Dallas/Fort Worth, Philadelphia, and even Fort Lauderdale. Part 135 operators may better target those cities for the Super Bowl driven demand.

Looking Ahead: Implications for Super Bowl LVIII

Armed with the knowledge from last year’s Super Bowl, Part 135 operators can strategize to optimize their services for this year’s game. Identifying and targeting the top origin cities that led the surge in private flights can help refine marketing campaigns and service offerings. Operators can also leverage the increased demand for charter services in these areas by providing bespoke travel packages and flexible options that cater to the unique needs of Super Bowl attendees.

Conclusion

The approach of Super Bowl LVIII serves as an exciting period for the private aviation sector, especially for Part 135 operators looking to capitalize on the event-driven demand. By examining the Super Bowl LVII flight surge data, operators can pinpoint where to focus their efforts, tailor their services, and ensure readiness for last-minute bookings to fully harness the potential of this annual sporting phenomenon. The data from 2023 is not just a record of past successes but a playbook for future triumphs in the competitive skies of private aviation.