The US BizAv (Business Aviation) market has been booming since March 2021. This series of articles track the traffic trend of this market. We define the BizAv market as part-135 on-demand for-hire private flying by business jets or certain turboprop planes. The numbers in the following charts exclude part-91 private flights. If you are interested in all flights by business jets, or detailed flights by route and operator, please get in touch with us.

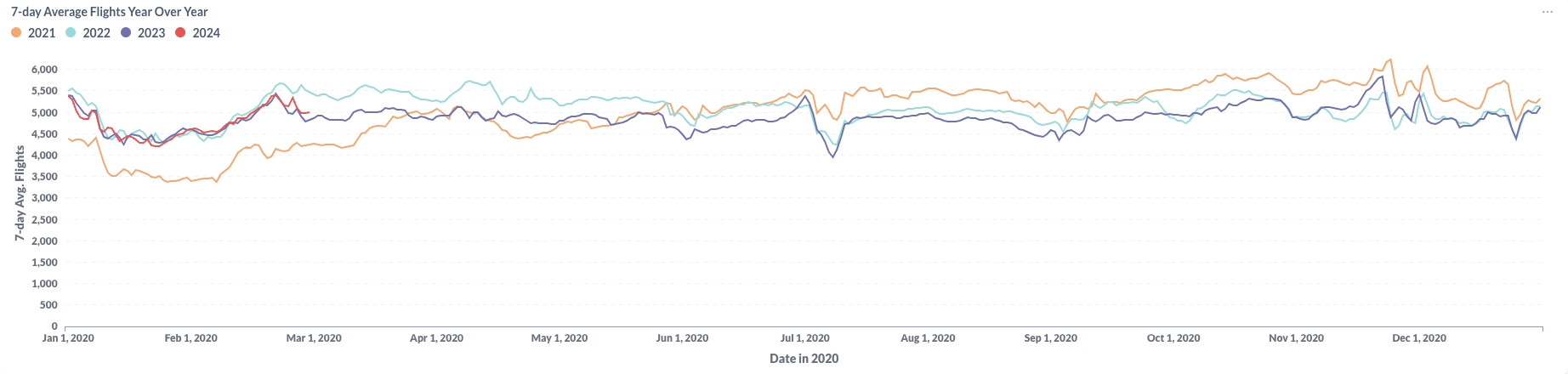

Figure 1: Year over Year Trend of the U.S. BizAv Market

Figure 1 illustrates the trends in U.S. Business Aviation (BizAv) traffic from January 2021 to February 2024. In February 2024, the flight activity trend positioned itself between the curves of 2022 and 2023, leaning closer to the lower levels observed in 2023.

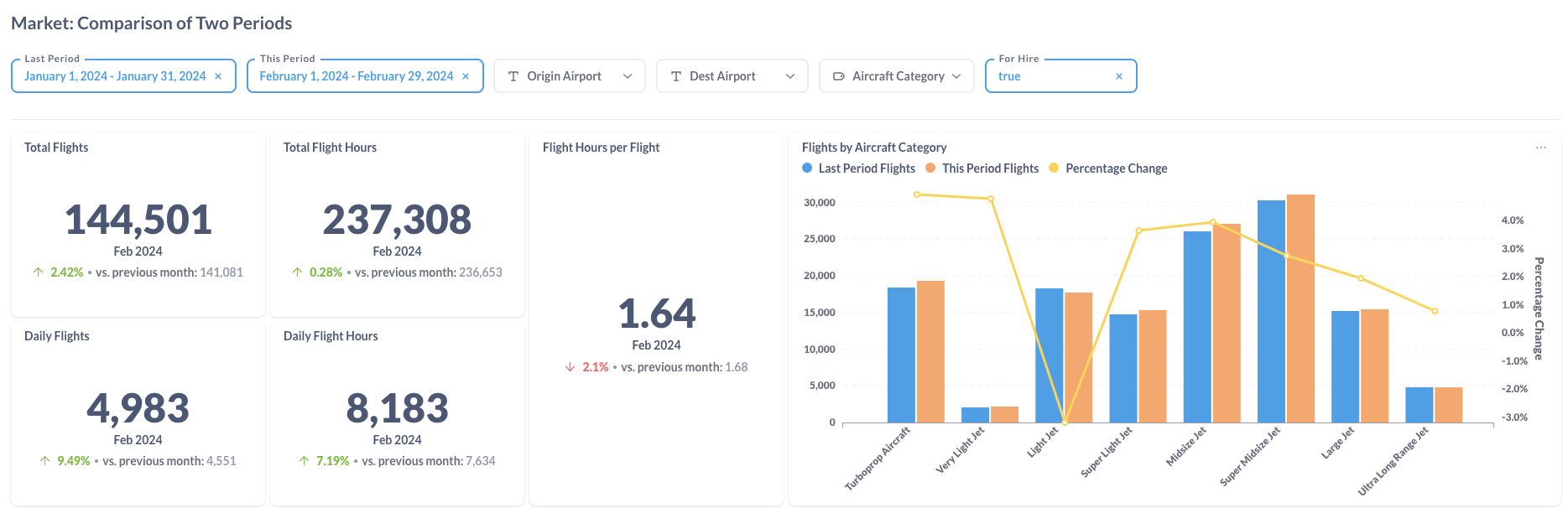

Figure 2: Comparison of the U.S. BizAv Flights This Month vs. Last Month

Figure 2 presents a comparative analysis of flight data between January 2024 and February 2024, revealing a 9.5% rise in daily flight frequency in February compared to January. The increase in total daily flight hours was somewhat more modest, at 7.2%. Interestingly, the average flight duration per departure saw a decrease of 2.1%. This decline was attributed to the more substantial growth in flight activities by Turboprop and Very Light Jets, which recorded increases of 4.9% and 4.8% respectively, outpacing the growth of larger jets. Conversely, flights by Light Jets experienced a downturn, with a decrease of 3.2%.

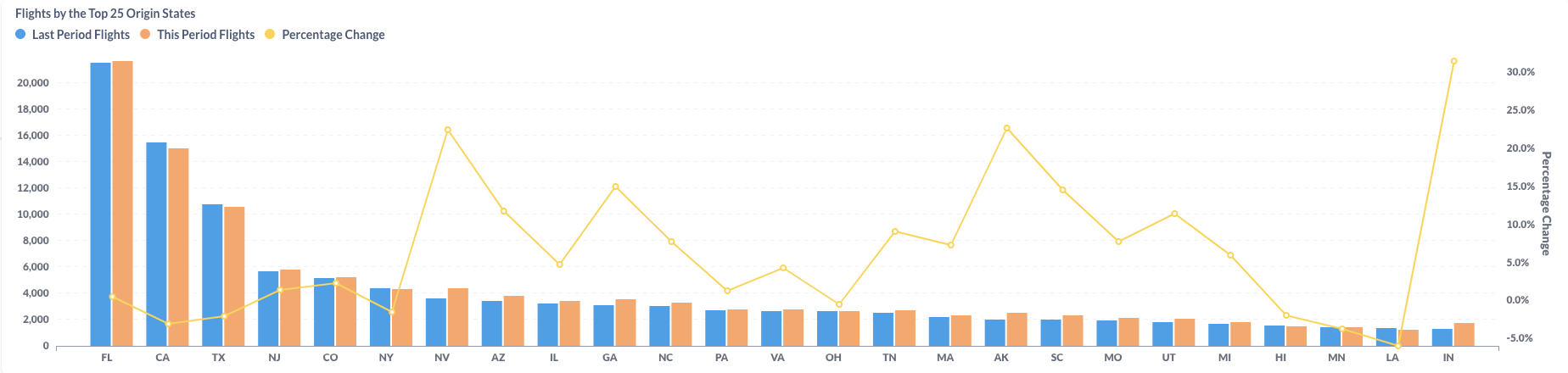

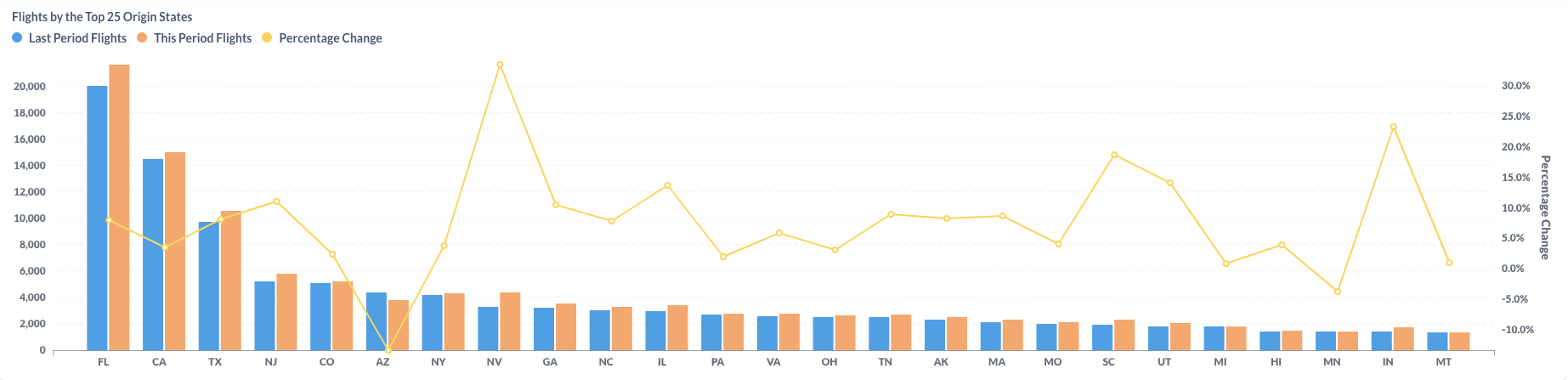

Figure 3: Comparison of the U.S. BizAv Flights by the Top 25 Origin States (This Month vs. Last Month)

Between January 2024 and February 2024, aviation activity experienced significant growth in several U.S. states, including Nevada (NV), Georgia (GA), Alaska (AK), and Indiana (IN). Notably, Florida (FL), the state with the highest volume of Business Aviation (BizAv) activity, recorded a 0.5% increase in flights in February compared to January, despite February having two fewer days. Conversely, California (CA) and Texas (TX) saw a decrease in aviation activity, with declines of 3.0% and 2.0% respectively, on a month-to-month basis.

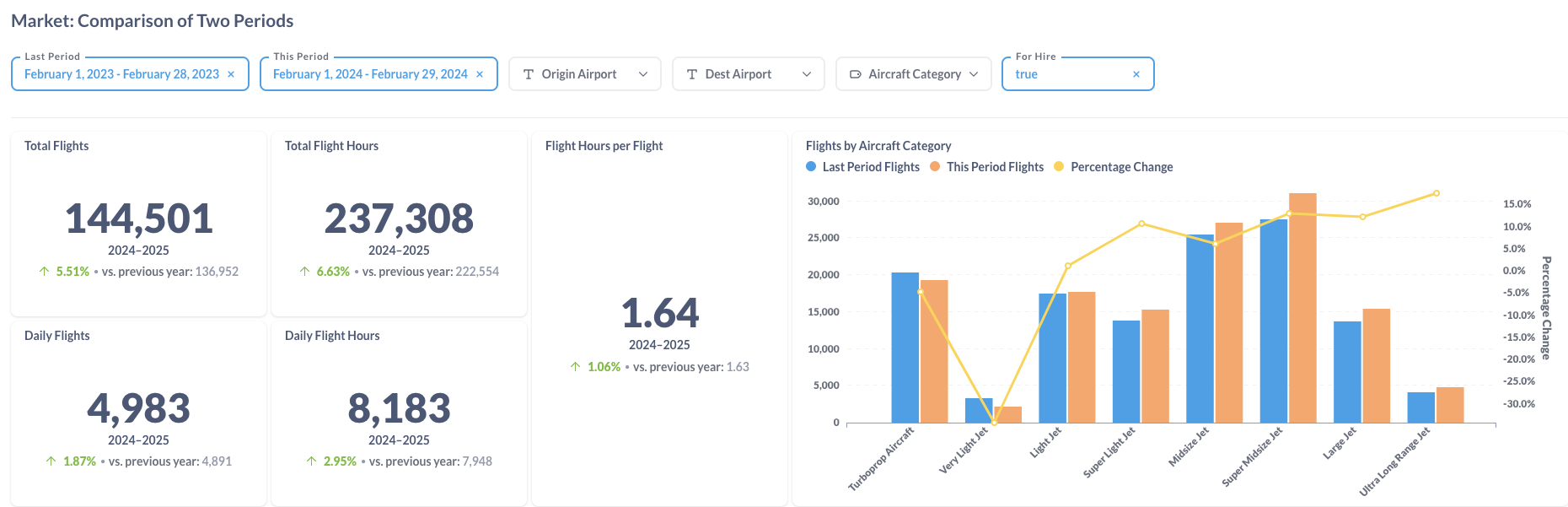

Figure 4: Comparison of the U.S. BizAv Flights This Year vs. Last Year

Thanks to the leap year, February of this year, compared to February 2023, saw a 1.87% increase in the number of flights and a 2.95% rise in flight hours, attributable to a 1.06% increase in average flight hours per flight. Among the different aircraft types, Very Light Jets experienced a significant decline of 34.3%, while Turboprop aircraft recorded a 4.8% decrease. Conversely, the larger aircraft categories, including Super Midsize Jets, Large Jets, and Ultra Long Range Jets, observed increases ranging from 1.2% to 17.6%. This trend suggests a shift in customer preference towards larger aircraft over the previous year.

Figure 5: Comparison of the U.S. BizAv Flights by the Top 25 Origin States (This Year vs. Last Year)

Comparing flight data from February 2023 to February 2024, the majority of larger states experienced an uptick in total flight activity. The top three states by activity, Florida (FL), California (CA), and Texas (TX), all recorded increases in their flight operations, with growth rates between 3.6% and 8.1%. In contrast, Arizona (AZ) witnessed a significant decline in flight activity, with a decrease of 13.4%.

To summarize, from February 2023 to February 2024, the U.S. Business Aviation (BizAv) market witnessed growth in states like Florida, California, and Texas, while Arizona saw a decline. A trend towards larger aircraft emerged, with declines in Very Light Jets and Turboprops against growth in larger jet categories. The leap year contributed to an increase in flights and flight hours, reflecting rising demand. Month-over-month data from January to February 2024 showed activity spikes in several states, despite declines in California and Texas, highlighting both seasonal fluctuations and a preference shift towards more capable aircraft within the BizAv sector.