COVID-19 is a disaster to many industries, especially travel-related businesses. Most people know that the aviation industry is a victim of COVID. It is true for commercial airlines. But the business aviation sector is actually boosted by coronavirus concerns. In this article, we will compare US air traffic of commercial air versus business aviation in the past 4 years.

Commercial Air

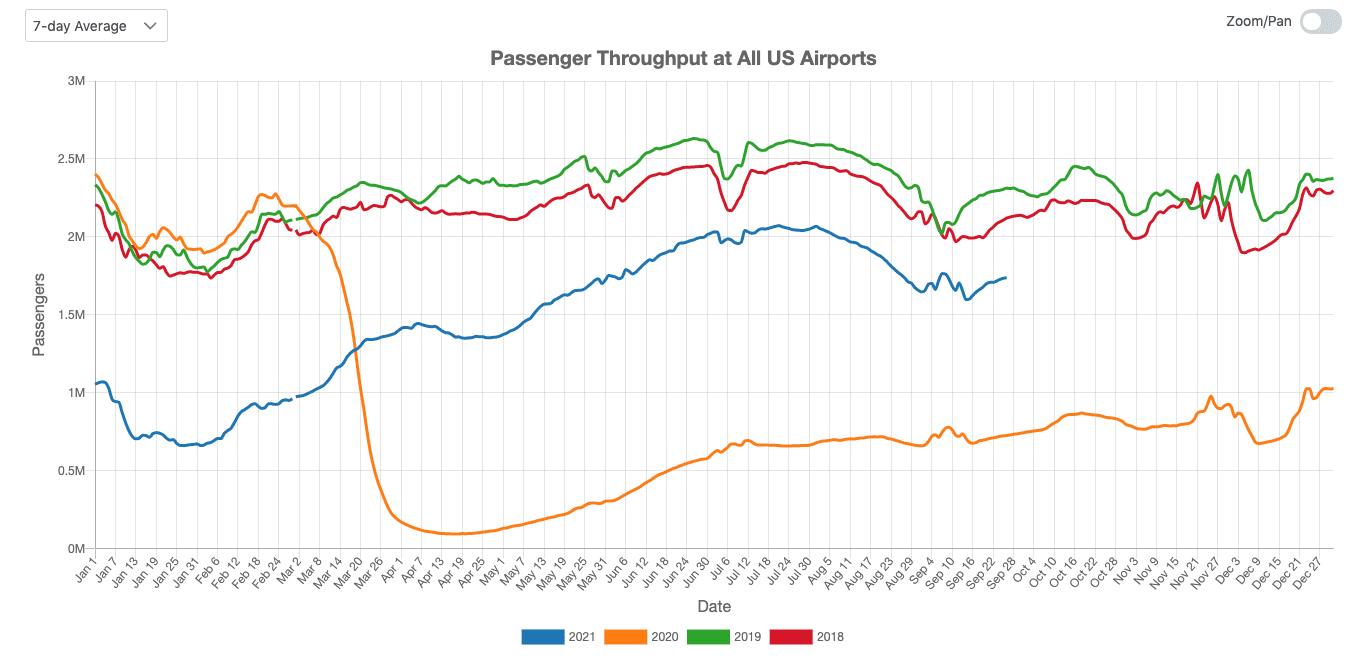

For commercial air transportation, we use passenger throughput at all U.S. airports as a traffic indicator. Below is a chart from FlightBI based on data from the U.S. Transportation Security Administration (TSA). As shown in the chart, air traffic after the outbreak of COVID is more like an “L” shape. There was a strong recovery in the first half of 2021. Unfortunately, a widespread Delta variant stopped the momentum. As a result, the overall commercial air traffic is still around 80% of the pre-COVID level.

Business Aviation

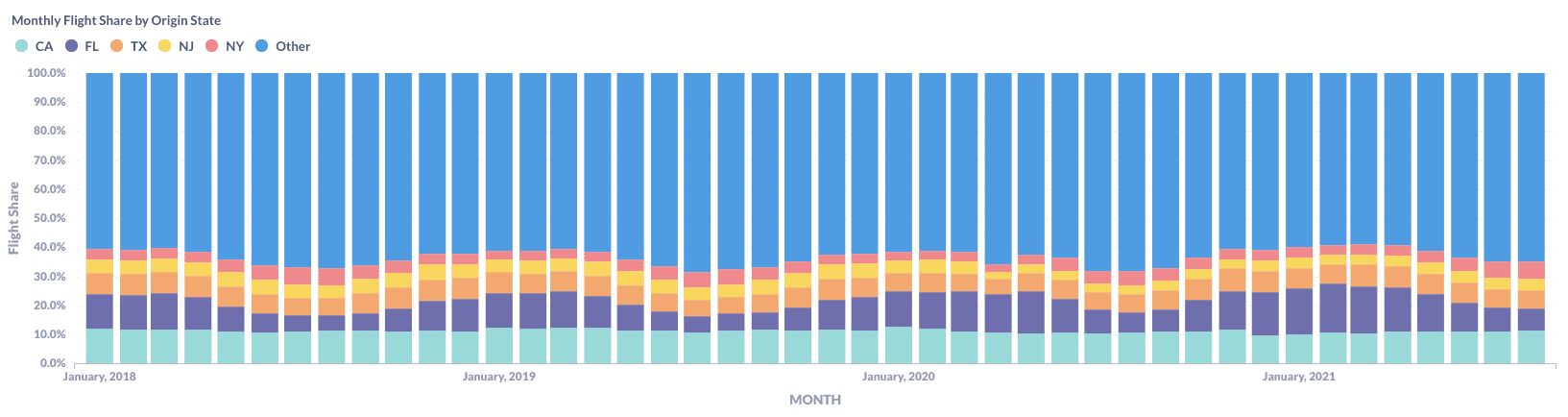

Commercial aviation has a seasonality. In a normal year, there is more traffic during the summer than that in the winter. However, business aviation traffic is relatively flat in a normal year. There are still some patterns of ups and downs. For example, traffic in the July 4th week is always low. Traffic from specific locations may also have a seasonality. As shown in the chart of business aviation flights by origin state below, Florida (FL) is a strong seasonal market.

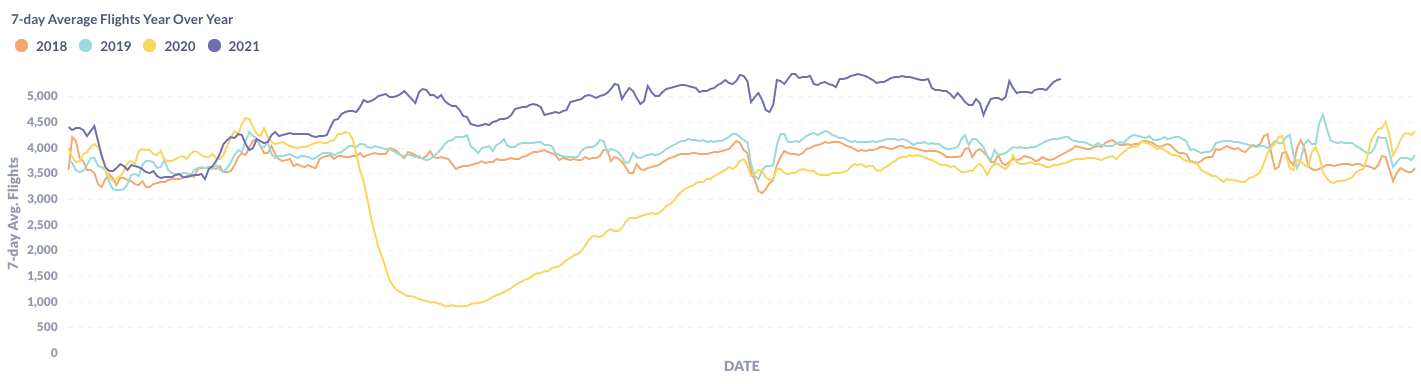

For business aviation, we chose the number of flights by turboprop or jet airplanes for business purposes as a traffic indicator. The data was collected from the Federal Aviation Administration (FAA) and processed by FlightBI. In 2018 and 2019, there were about 4,000 flights per day flying in the U.S., including those from/to foreign countries. The outbreak of COVID hit this sector too, but the recovery after is more like a “V” shape. By the summer of 2020, the average traffic of business flight almost came back to the 2018/2019 level.

The situation got even better this year. As shown in the chart below, the business aviation sector has boomed since March 2021. For the whole summer, about 30% more flights were tracked by FAA than those in the same period of 2018/2019. By the publishing time of this article, the demand is still soaring. Why?

Thanks to COVID, travelers started giving more priority to safety and convenience when choosing their travel approaches. Compared with taking a commercial flight, traveling on a business jet is safer, faster, and more private. With a private flight, you don’t need to wait in long security lines and stay in an isolated fuselage for hours with hundreds of strangers. You don’t need to follow strict CDC rules and don’t take temperature checks. Furthermore, you don’t need to worry about more delays or cancellations caused by virus-related events. COVID emphasized the benefits of private flying, thus boosting the demand for business aviation.

Comparison

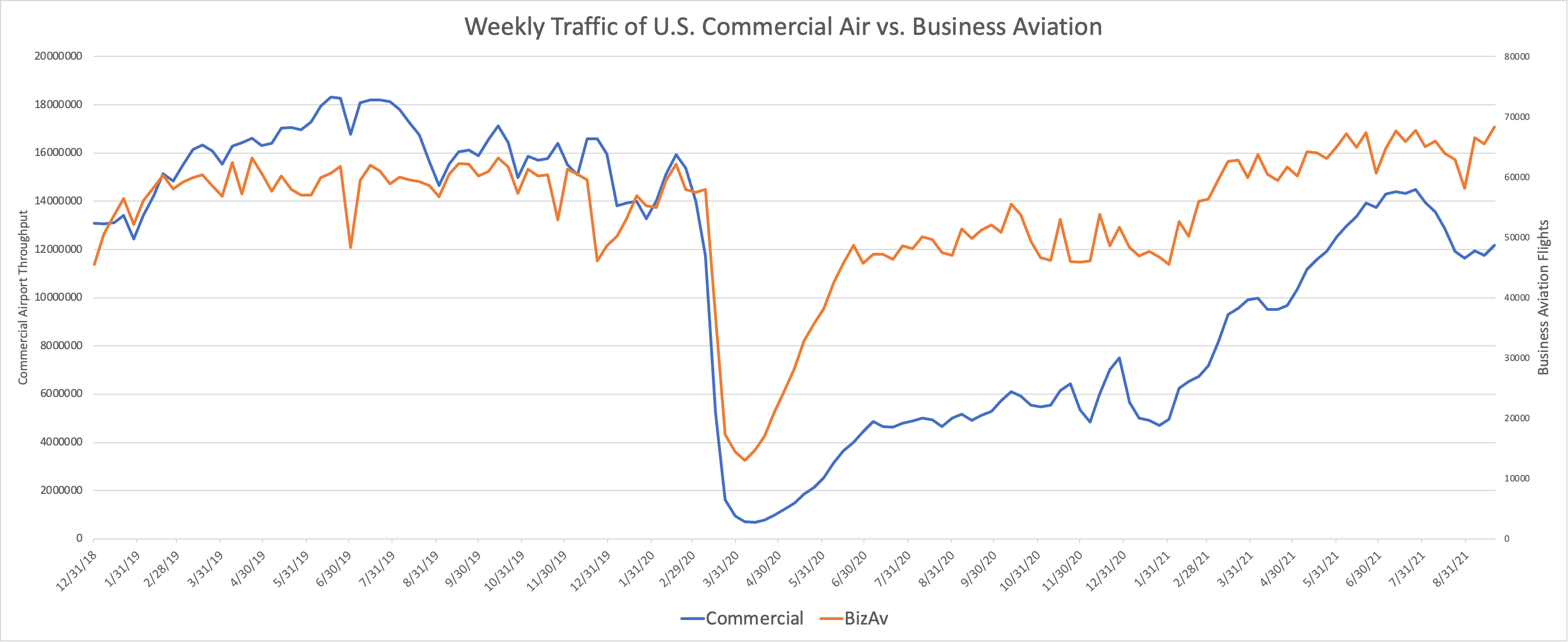

In the chart below, we put those two sectors together. At almost the same time, both sectors were hit by the virus outbreak, but the commercial sector was impacted more severely. in April 2020, commercial air traffic was at less than 5% of its 2019 level. On the contrary, business aviation traffic still had more than 20% of its pre-crisis level. Then the business aviation sector recovered quickly while the commercial sector lagged behind. This spring and summer were not bad for commercial airlines. Traffic grew quickly, led by leisure and low-cost carriers such as Frontier Airlines and Allegiant Air. But the Delta variant pushed back the commercial sector again.

The business aviation sector is welcoming a demand peak not seen over many years. But will this demand boost last? After the virus goes away, I think the demand for business aviation will cool down a bit. However, some of them will stay. People who have taken a marketing course know customers go through three phases to complete sales – awareness, trial, and repurchase. COVID helped them move from phase I to phase II. Those first-time users of private flying will like the benefits. Some of them will go back to commercial services due to the significant price difference, but others will stay.