Traffic and fare data by airline and route can provide valuable insights into market trends, demand, and competition. By analyzing this data, airlines can optimize their pricing strategies, plan their capacity, and make informed decisions about their route network. The data can also be used for market and competitive analysis, helping airlines identify profitable routes and gain a competitive advantage.

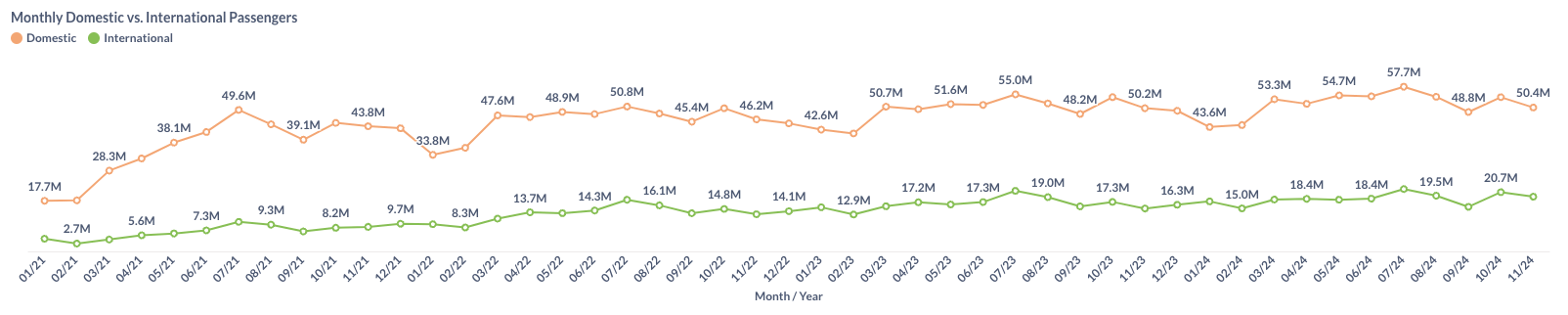

Based on initial true O&D level data from FlightBI released this week, total US domestic air travel continue to decline in November 2024 from the previous month, reflecting typical seasonal patterns. Likewise, U.S. international air travel saw a decrease, while average airfares increased during this period.

Volume Trend

In November 2024, domestic passenger numbers fell from 54.0 million in October to 50.4 million, though this is still higher than November 2023’s 50.2 million. In the international sector, passenger numbers declined from 20.7 million in October to 19.1 million in November 2024.

Figure 1: US Domestic and International Air Traffic by Month

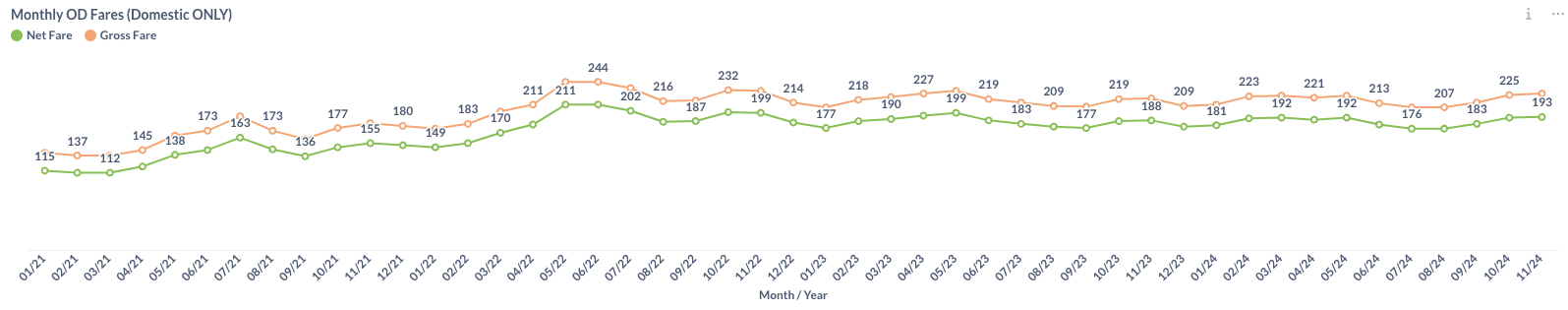

Airfare Trend

Airfares continue to rise. The average gross fare increased from $225 in October to $227 in November, while the average net fare also climbed from $192 to $193 during the same period.

Figure 2: US Domestic Average Airfare by Month

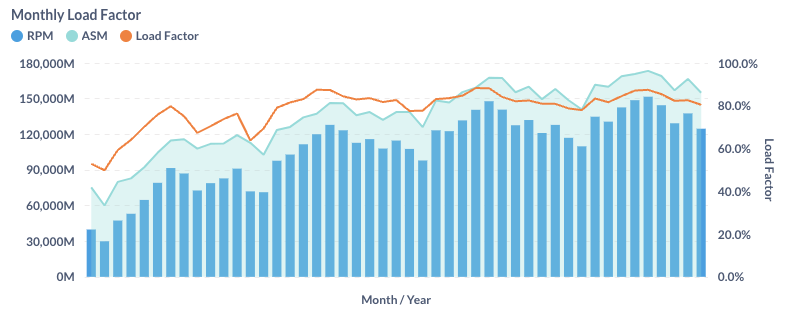

Load Factor Trend

In November 2024, both Available Seat Miles (ASM) and Revenue Passenger Miles (RPM) declined from the previous month. The average load factor for major U.S. airlines also fell to 80.5%, as shown in Figure 3., which is lower than the 81.0% recorded in November 2023.

Figure 3: US Airlines’ Average Load Factor by Month

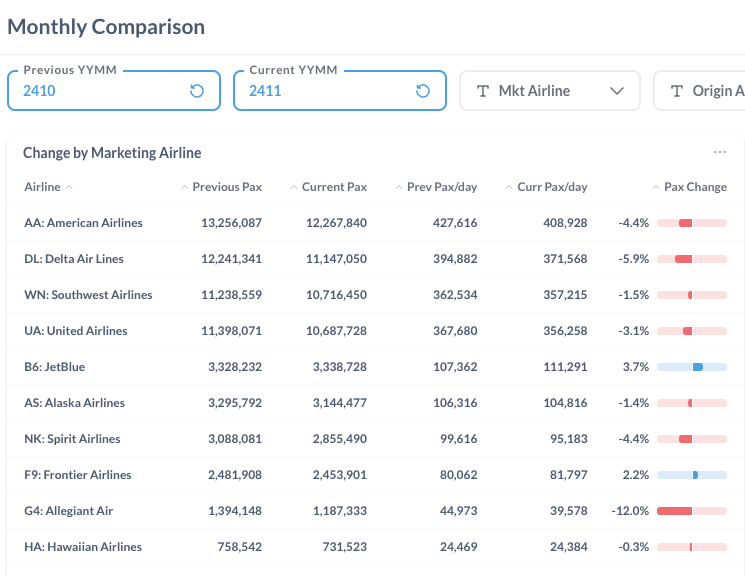

Month Over Month Comparison

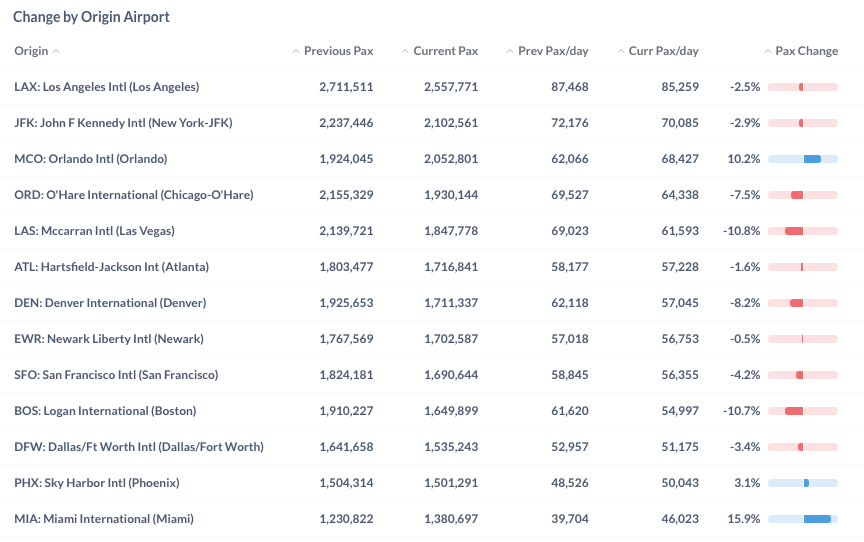

In November 2024, most major U.S. airlines experienced a decline in daily traffic compared to October. Allegiant (G4) saw the largest drop, with a 12.0% decrease due to significant capacity cuts. However, JetBlue (B6) and Frontier (F9) reported modest growth of 3.7% and 2.2%, respectively.

Figure 4: Air Traffic by Dominant Marketing Airlines in October 2024 (Previous) vs. November 2024 (Current)

During this period, traffic declined at most airports, with Las Vegas (LAS) and Boston (BOS) showing month-over-month decreases of 10.8% and 10.7%, respectively. On the other hand, Miami (MIA) and Orlando (MCO) welcomed 15.9% and 10.2% increase in traffic over the same period.

Figure 5: Air Traffic by Top Origin Airports in October 2024 (Previous) vs. November 2024 (Current)

Year Over Year Comparison

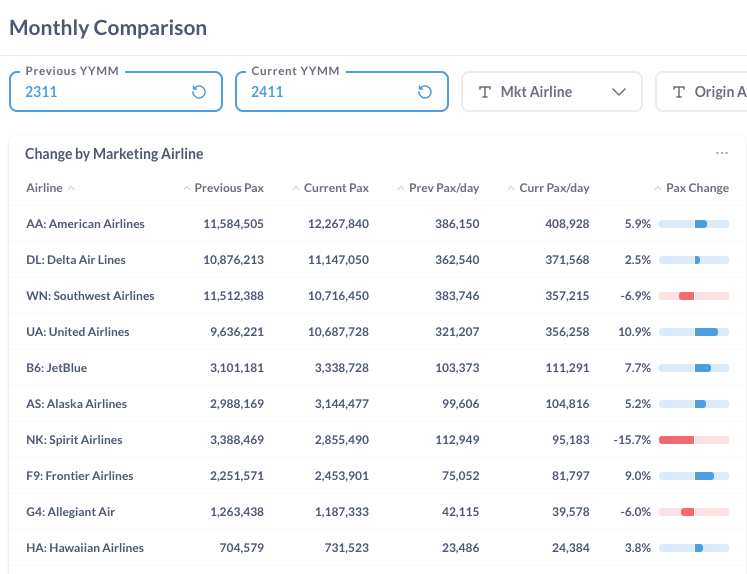

Between November 2023 and November 2024, most major U.S. airlines experienced growth, led by United (UA), Frontier (F9), and JetBlue (B6), with increases of 10.9%, 9.0%, and 7.7%, respectively. In contrast, Spirit (NK) reported 15.7% of decrease because it filed Chapter 11 bankruptcy.

Figure 6: Air Traffic by Dominant Marketing Airlines in November 2024 (Current) vs. November 2023 (Previous)

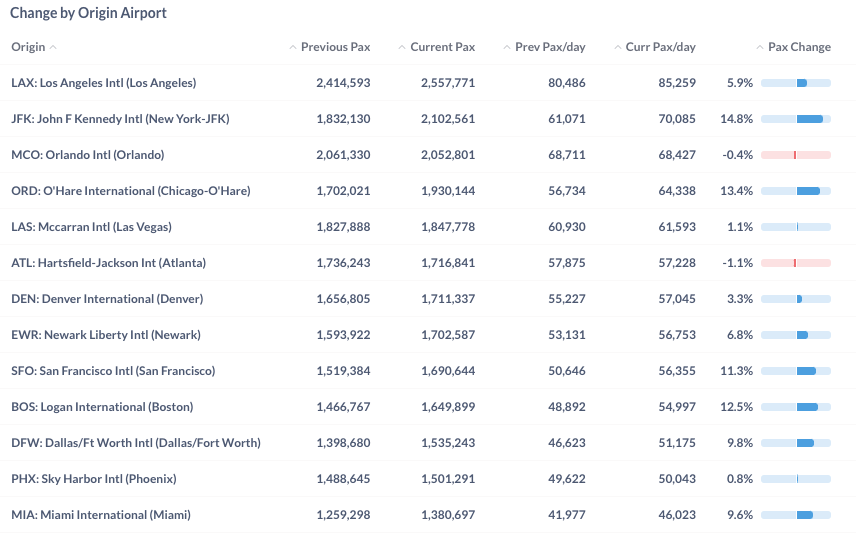

From November 2023 to November 2024, most major airports saw increased traffic, led by New York (JFK), Chicago (ORD) and Boston with year-over-year growth of 14.8%, 13.4% and 12.5%, respectively.

Figure 7: Air Traffic by Top Origin Airport in November 2024 (Current) vs. November 2023 (Previous)

For more detailed information on traffic and fares by route and airline, please contact service@flightbi.com or request a demo of Fligence USOD. They will be able to provide you with customized information to meet your specific needs and requirements.