Daily and hourly airport traffic is crucial for businesses related to airports, including airport authorities, airlines, retailers, ground handlers, rental car companies, and hotels. If you belong to any of these industries, utilizing daily airport traffic data can help you plan your operations, schedule your resources, forecast revenue, and plan budgets more accurately. Additionally, this data can help you target your marketing and promotional efforts more specifically, leading to more effective business strategies.

FlightBI collects and normalizes the airport passenger throughput data from US Transportation Security Administration (TSA). In addition, it has developed a product called Fligence TSA, which features a wide variety of data visualizations. FlightBI is currently offering a two-week, no-obligation trial of Fligence TSA for you to explore valuable insights from the airport traffic data.

This article summarizes US air traffic using the aforementioned tool, utilizing actual airport-level data as of Nov 9, 2024. Our analysis will examine trends in different segments of air travel, such as domestic versus international flights and leisure versus business travel. To learn more about the specific airports chosen to represent these markets, please refer to this article.

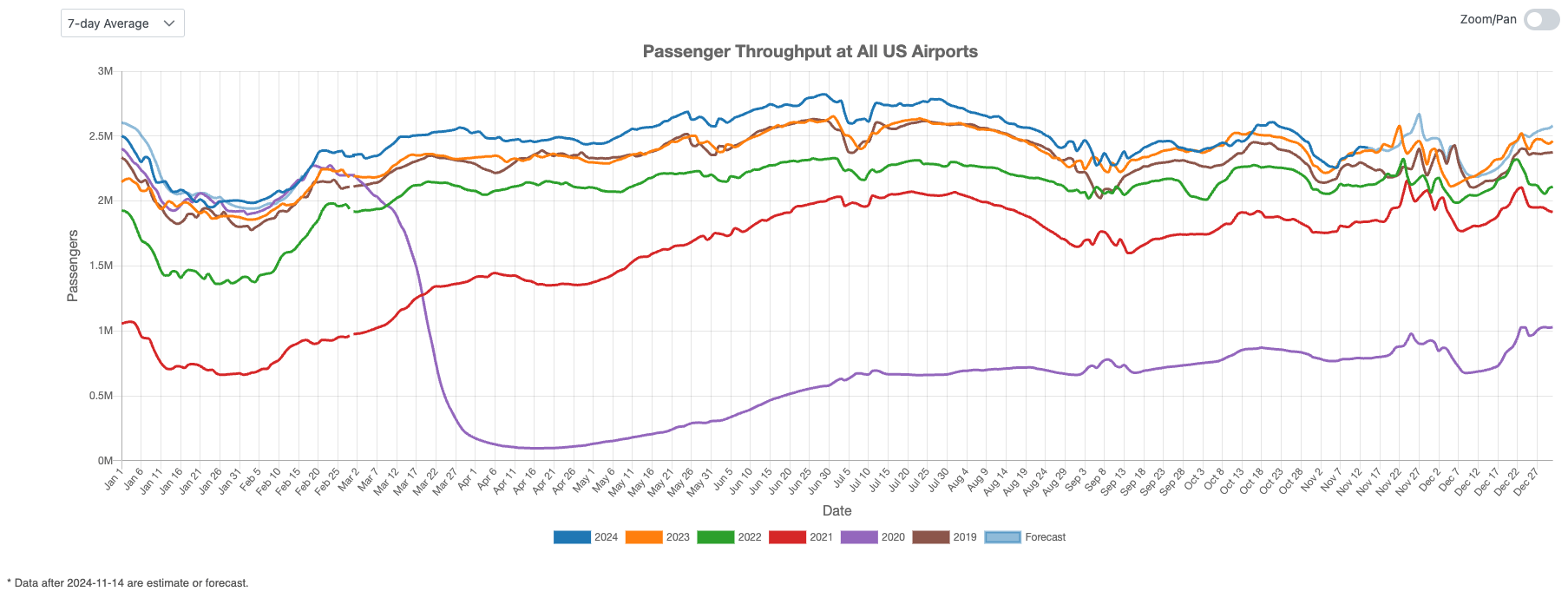

U.S. Airport Traffic Overview

U.S. airport traffic saw a healthy growth in the first three quarters in 2024. However, the growth rate slowed to less than 3% in October, as shown in Figure 1. Since mid-February 2024, air traffic has remained at its highest levels in five years, and this upward trend may go away in December.

Figure 1: US Overall Air Traffic Trend

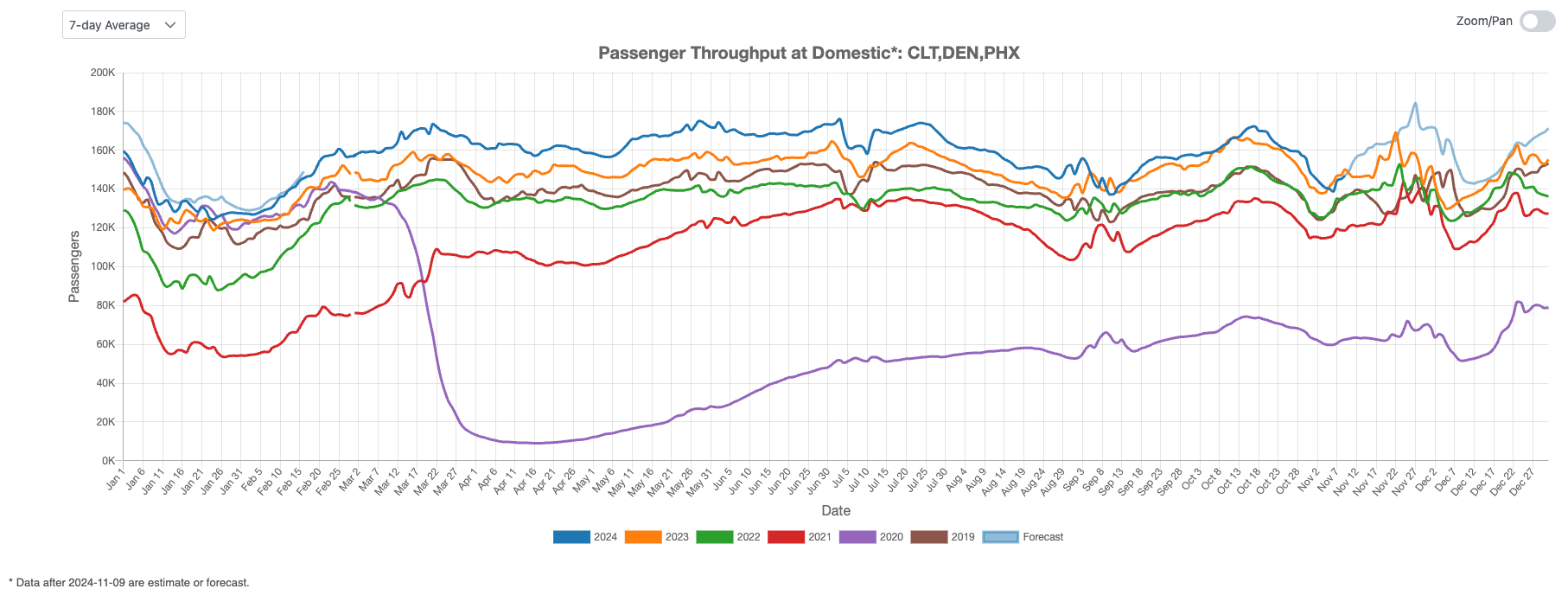

Domestic Airport Traffic Indicator

Figure 2 shows a steady year-over-year growth in U.S. domestic air travel throughout October. Due to seasonality, domestic traffic typically declined in October. Projections are still positive, indicating that domestic air traffic may reach another peak around the Thanksgiving holiday.

Figure 2: US Domestic Air Traffic Indicator

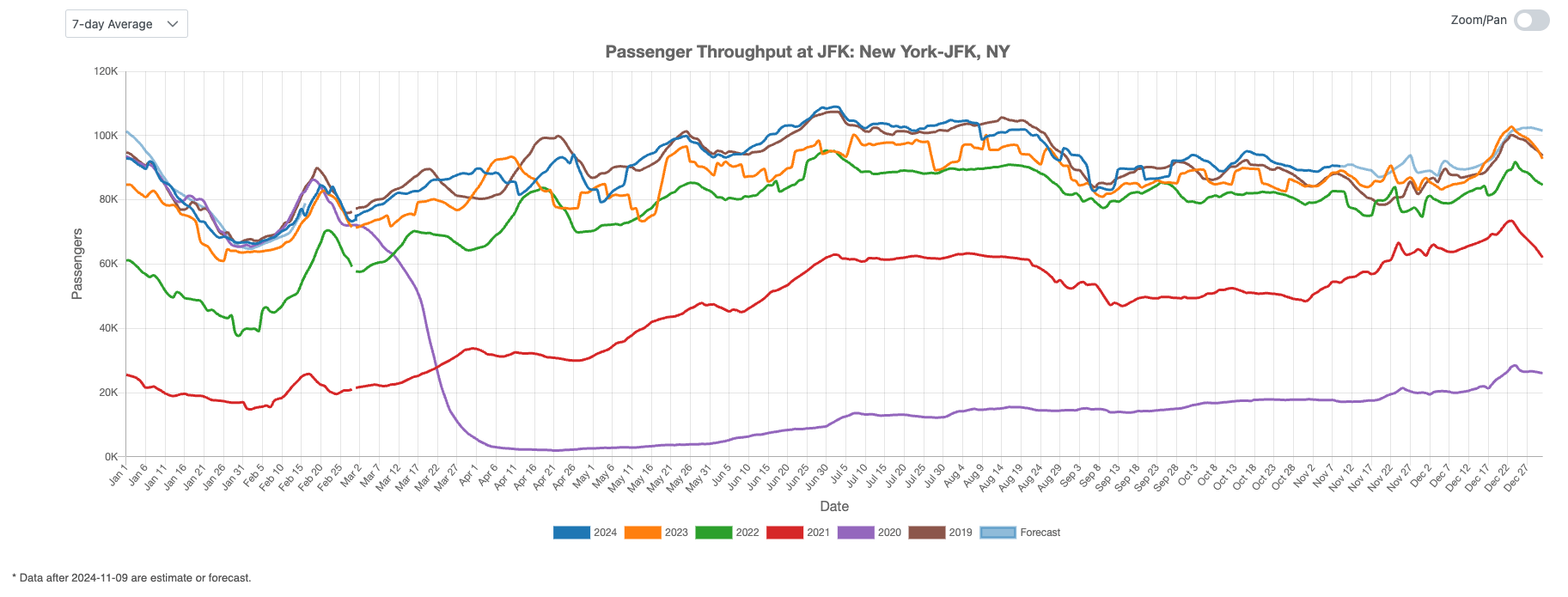

International Airport Traffic Indicator

Figure 3 displays the U.S. international air traffic index for October 2024, which is slightly higher than the pre-COVID levels. Projections indicate that U.S. international air traffic will remain relatively flat over the next two months and pick up around the Christmas.

Figure 3: US International Air Traffic Indicator

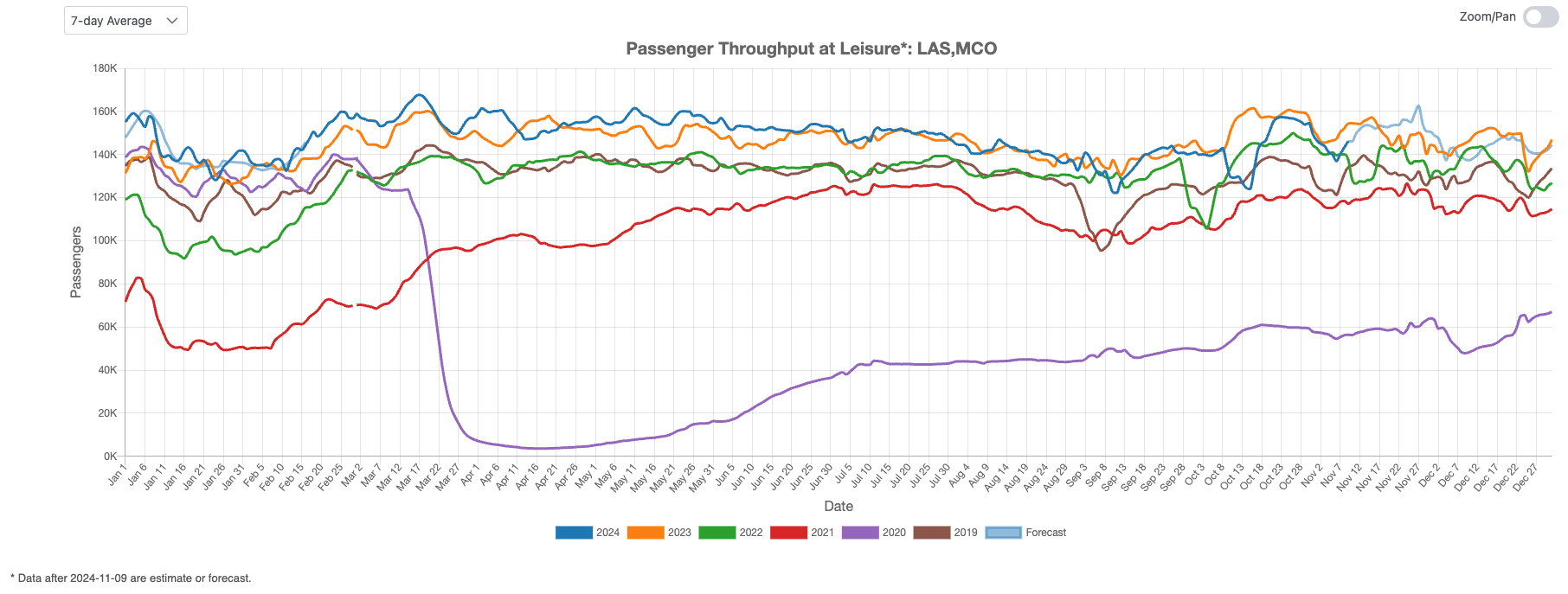

Leisure Air Traffic Indicator

Figure 4 highlights the current state of the U.S. leisure air travel market. In October 2024, leisure traffic almost returned to last year’s levels. However, forecasts predict a similar pattern for the rest of year, with a potential peak around the Thanksgiving holiday.

Figure 4: US Leisure Air Traffic Indicator

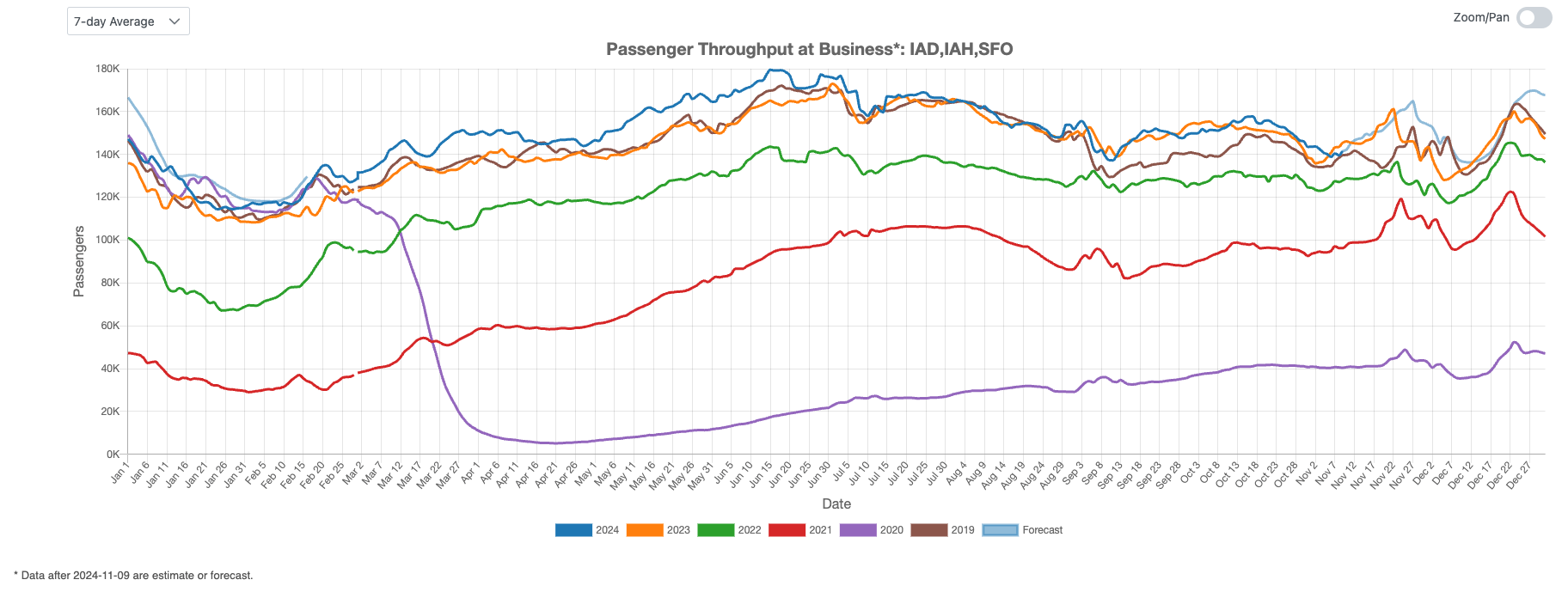

Business Air Traffic Indicator

Figure 5 illustrates the resurgence of business travel in October 2024, which lingers around last year’s level. Projections indicate that business travel is expected to gain more momentum in the next month.

Figure 5: US Business Air Traffic Indicator

In October 2024, U.S. airport traffic showed a small year-over-year growth. Both domestic travel and international traffic are healthy. Leisure traffic is expected to rebound by Thanksgiving. Business travel is projected to gain momentum in the following months.