Daily and hourly airport traffic is crucial for businesses related to airports, including airport authorities, airlines, retailers, ground handlers, rental car companies, and hotels. If you belong to any of these industries, utilizing daily airport traffic data can help you plan your operations, schedule your resources, forecast revenue, and plan budgets more accurately. Additionally, this data can help you target your marketing and promotional efforts more specifically, leading to more effective business strategies.

FlightBI collects and normalizes the airport passenger throughput data from US Transportation Security Administration (TSA). In addition, it has developed a product called Fligence TSA, which features a wide variety of data visualizations. FlightBI is currently offering a two-week, no-obligation trial of Fligence TSA for you to explore valuable insights from the airport traffic data.

This article summarizes US air traffic using the aforementioned tool, utilizing actual airport-level data as of Nov 30, 2024. Our analysis will examine trends in different segments of air travel, such as domestic versus international flights and leisure versus business travel. To learn more about the specific airports chosen to represent these markets, please refer to this article.

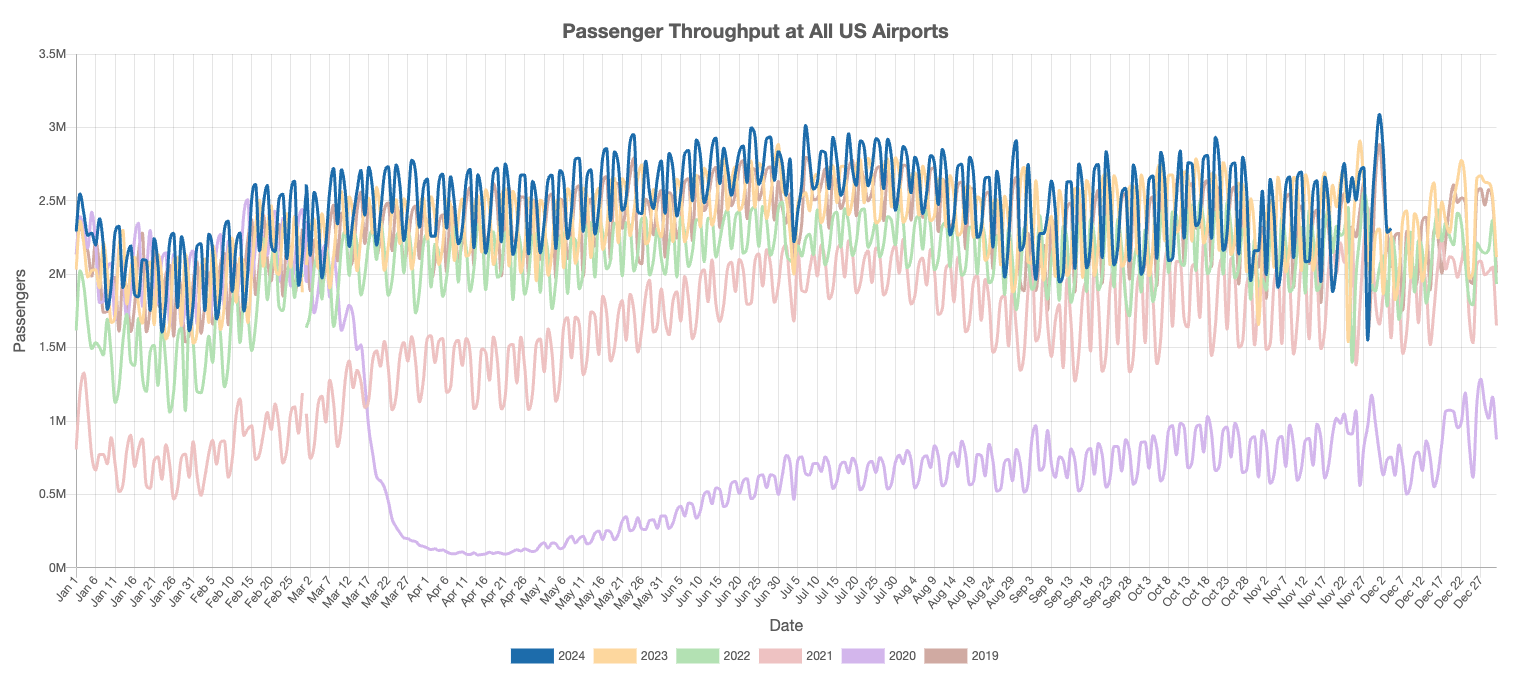

U.S. Airport Traffic Overview

Thanksgiving is one of the most significant holidays in the United States, and, like other major holidays, it influences air traffic patterns. As illustrated in Figure 1, U.S. daily air traffic reached its highest point this year on December 1st, with 3,087,393 passengers traveling—primarily as people returned to their home destinations. This figure represents a 6.6% increase compared to the same day last year.

Figure 1: US Overall Air Traffic Trend

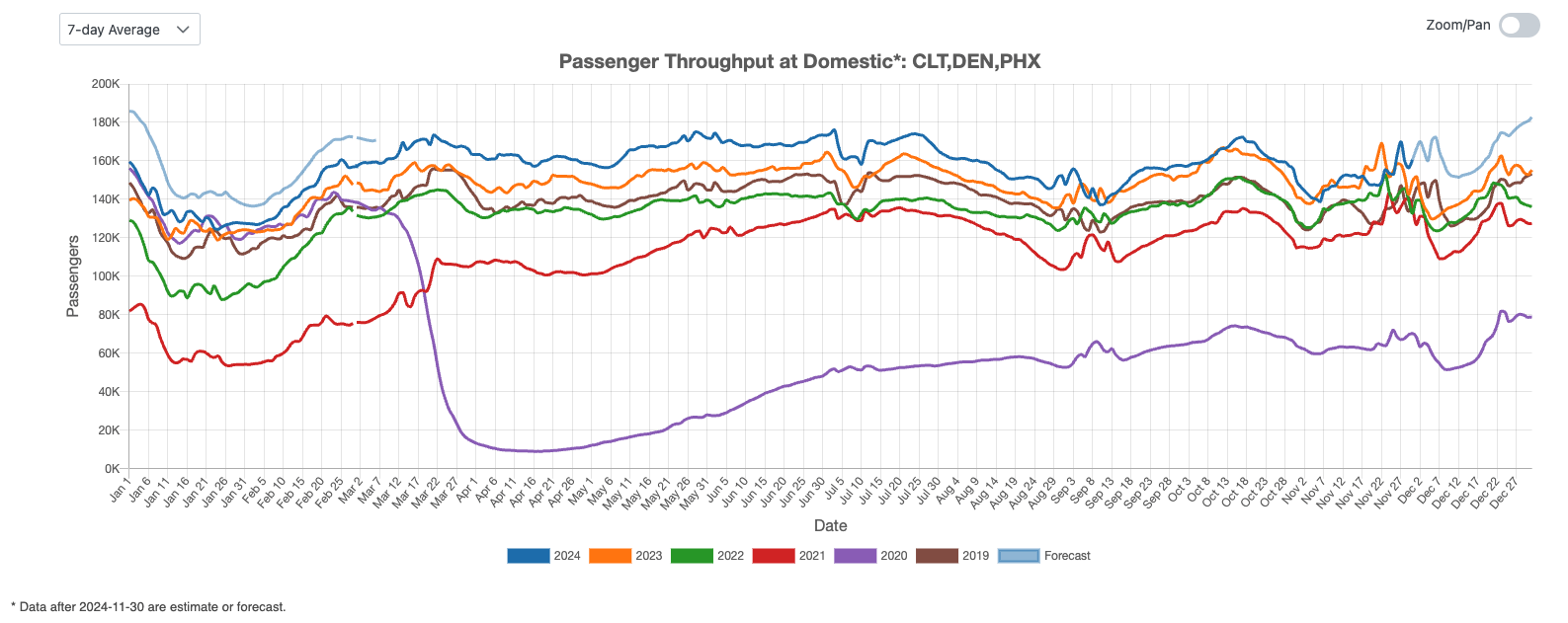

Domestic Airport Traffic Indicator

Figure 2 highlights steady year-over-year growth in U.S. domestic air travel throughout October. While domestic traffic typically decreases after Thanksgiving, projections remain optimistic, suggesting that domestic air traffic could experience another peak around Christmas.

Figure 2: US Domestic Air Traffic Indicator

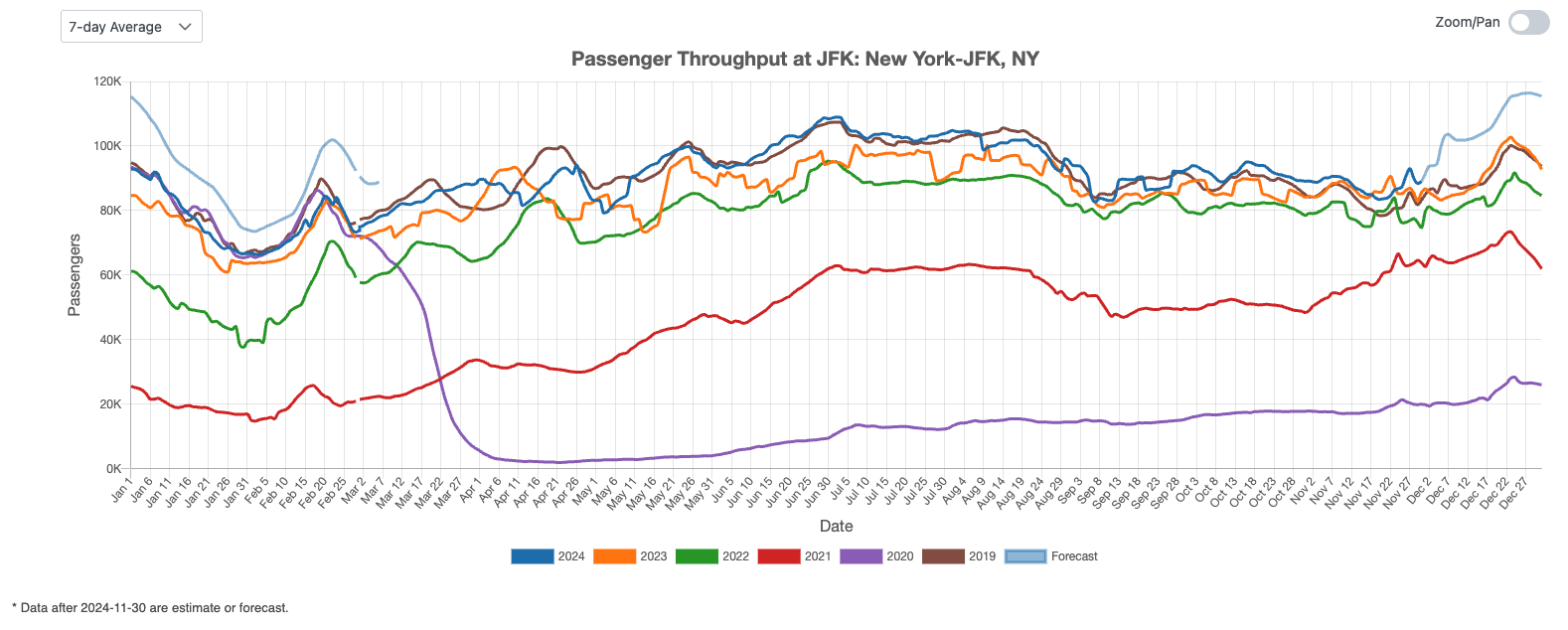

International Airport Traffic Indicator

Figure 3 illustrates the U.S. international air traffic index for November 2024, showing a slight increase compared to both last year and pre-COVID levels. Projections suggest continued growth in U.S. international air traffic throughout December.

Figure 3: US International Air Traffic Indicator

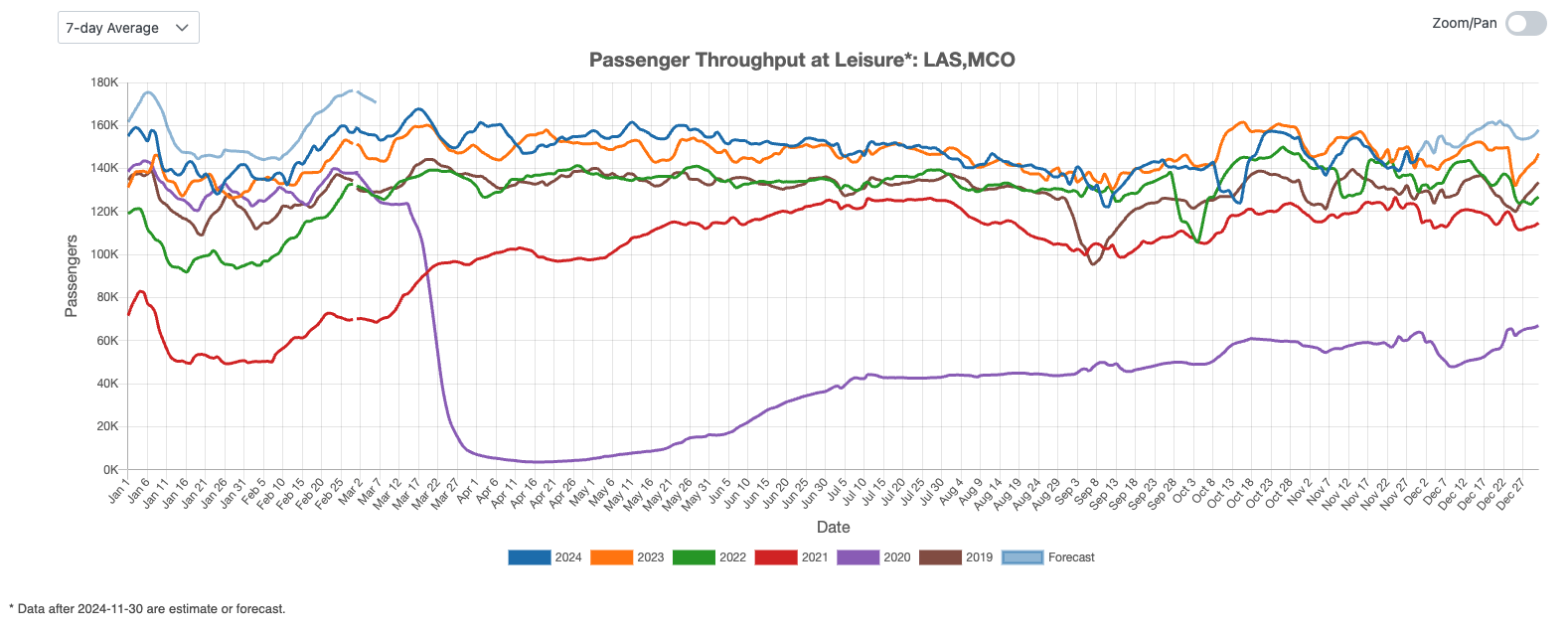

Leisure Air Traffic Indicator

Figure 4 provides an overview of the U.S. leisure air travel market. In November 2024, leisure traffic fell below last year’s levels. However, forecasts project growth for the remainder of the year, with a potential peak around Christmas and New Year’s Day.

Figure 4: US Leisure Air Traffic Indicator

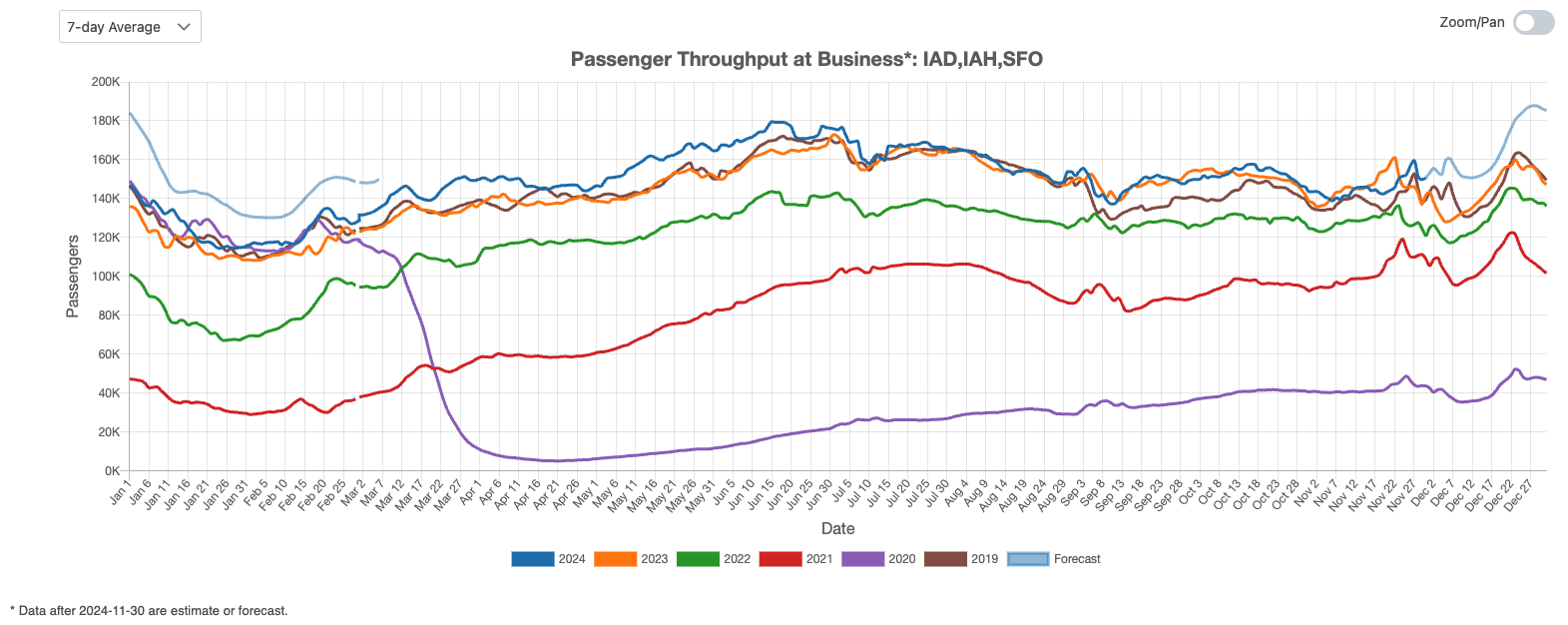

Business Air Traffic Indicator

Figure 5 depicts the resurgence of business travel in November 2024, remaining close to last year’s levels. Projections suggest that business travel is poised to gain further momentum in the coming month.

Figure 5: US Business Air Traffic Indicator

U.S. air traffic shows steady growth, with domestic travel peaking around Thanksgiving and expected to rise again at Christmas. International travel exceeds pre-COVID levels, while leisure travel lags slightly behind last year but is forecasted to improve. Business travel remains stable, with anticipated momentum in December.