Traffic and fare data by airline and route can provide valuable insights into market trends, demand, and competition. By analyzing this data, airlines can optimize their pricing strategies, plan their capacity, and make informed decisions about their route network. The data can also be used for market and competitive analysis, helping airlines identify profitable routes and gain a competitive advantage.

Based on initial true O&D level data from FlightBI released this week, total US domestic air travel saw an increase in June 2024 compared to the previous month. Similarly, US international air travel also experienced growth. Additionally, average airfares showed no change during this period.

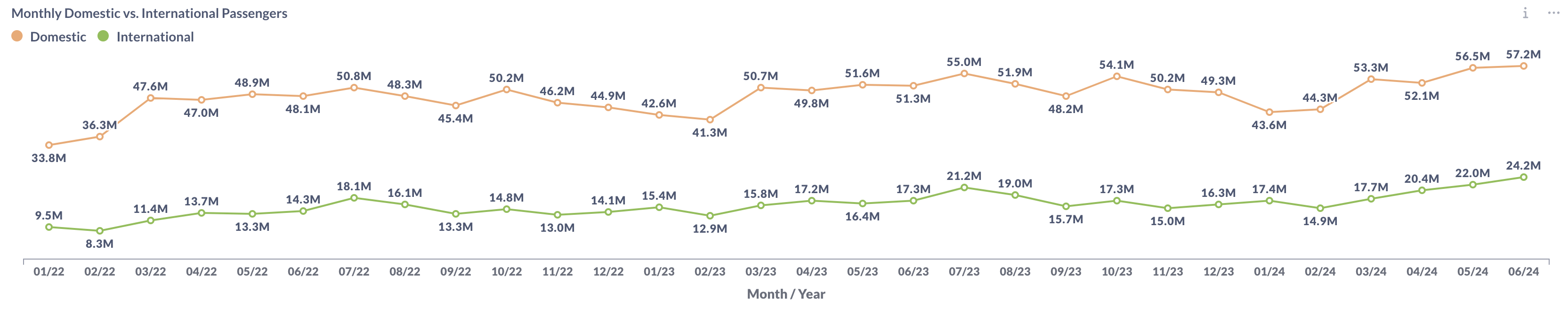

Volume Trend

In June 2024, domestic passenger numbers rose from 56.5 million in May to 57.2 million, marking a 11% increase compared to June 2023, which had 51.3 million passengers. Meanwhile, the international sector also grew, with passenger numbers increasing from 22.0 million in April to 24.2 million in June 2024.

Figure 1: US Domestic and International Air Traffic by Month

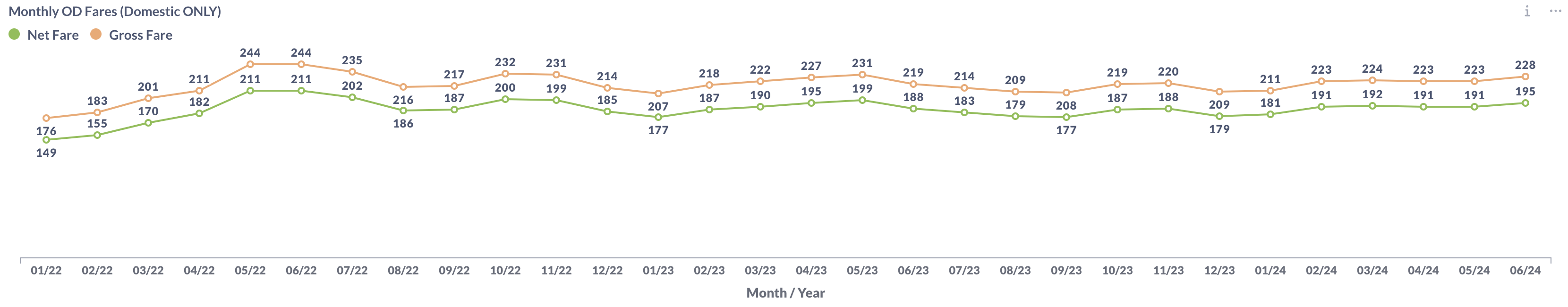

Airfare Trend

The latest data indicates that airfare start increasing again, with the average gross fare for flights at $228 in June. Similarly, the average net fare rose to $195 during the same period.

Figure 2: US Domestic Average Airfare by Month

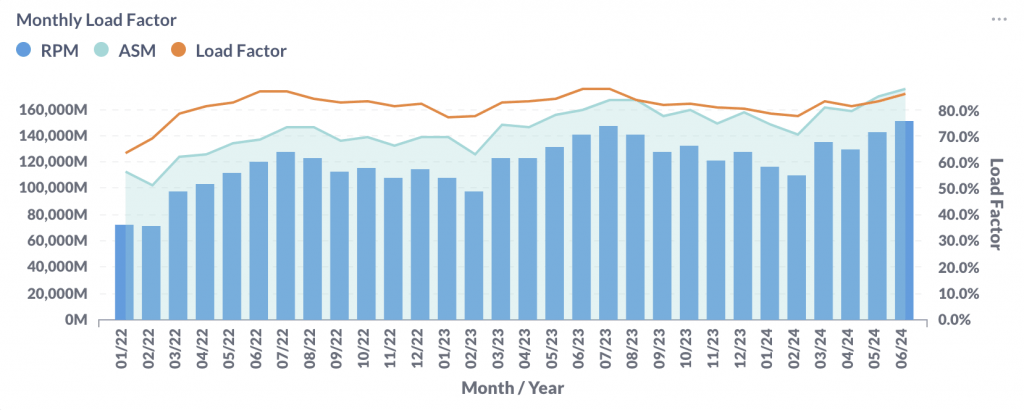

Load Factor Trend

In June 2024, both Available Seat Miles (ASM) and Revenue Passenger Miles (RPM) increased compared to the previous month. This resulted in a rebound in the average load factor for major US airlines, rising from 83.7% in May to 86.5% in June, as shown in Figure 3. However, the average load factor remains below the 88.3% recorded in June 2023.

Figure 3: US Airlines’ Average Load Factor by Month

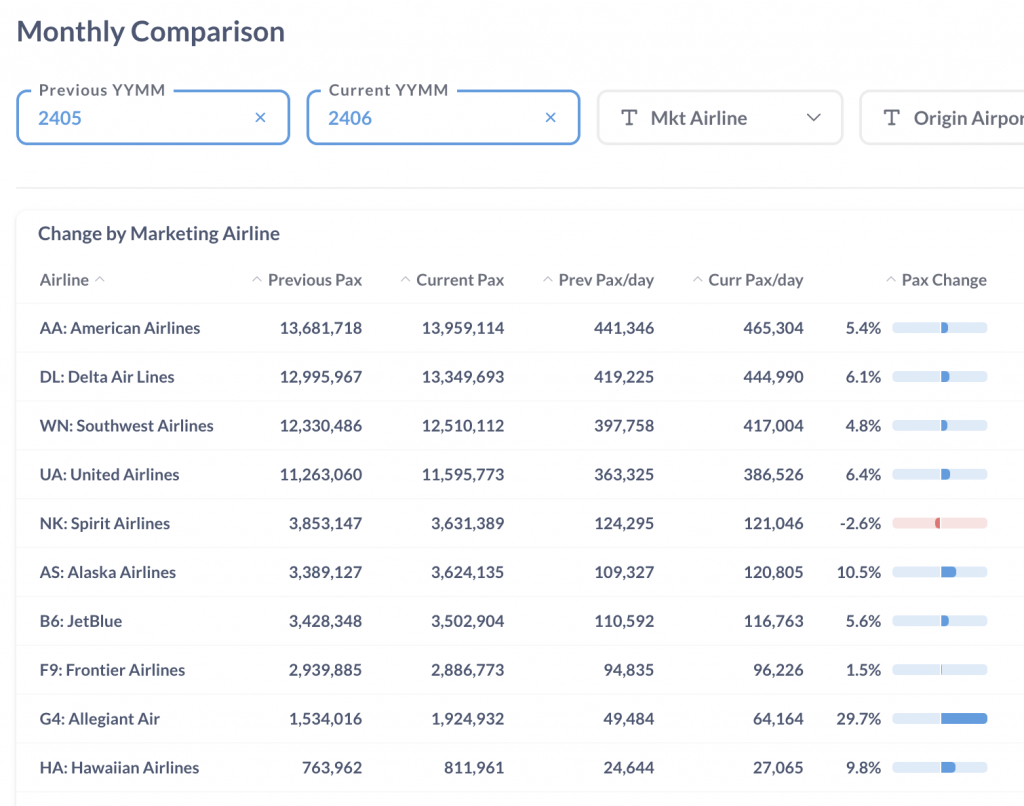

Month Over Month Comparison

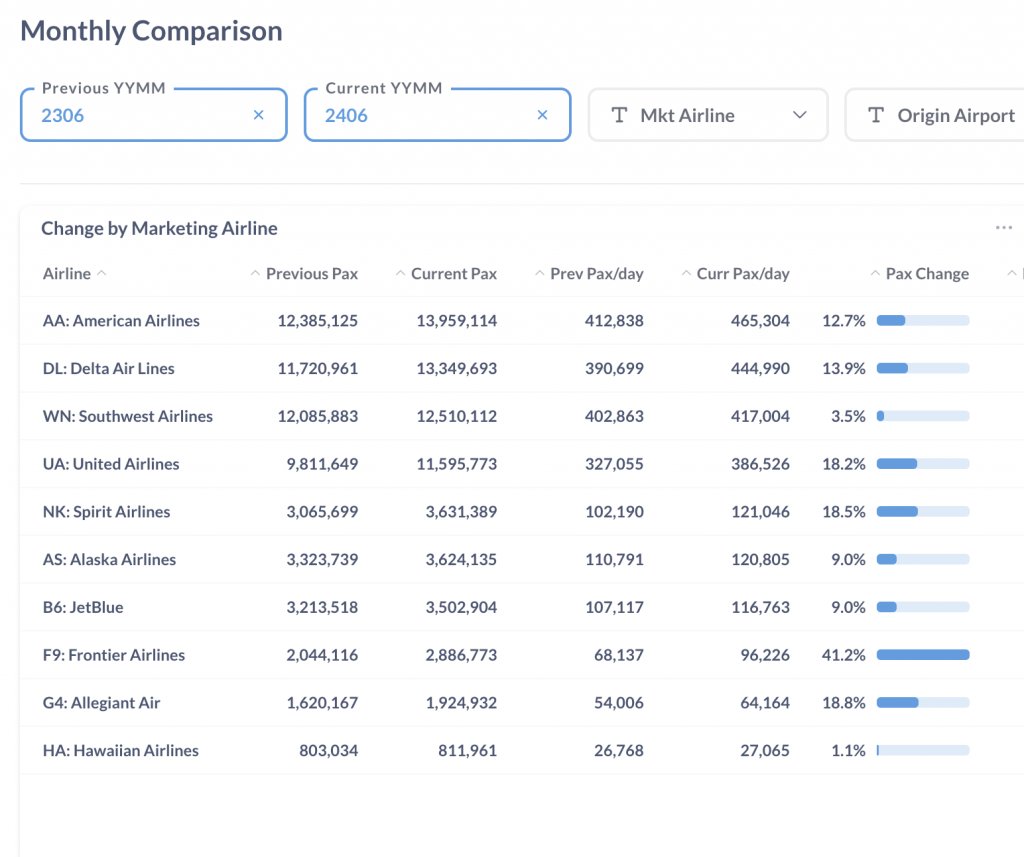

In June 2024, all major US airlines except Spirit Airlines (NK) saw an increase in daily traffic compared to May 2024. Notably, Allegiant Air (G4) achieved an impressive 29.7% growth.

Figure 4: Air Traffic by Dominant Marketing Airlines in May 2024 (Previous) vs. Jun 2024 (Current)

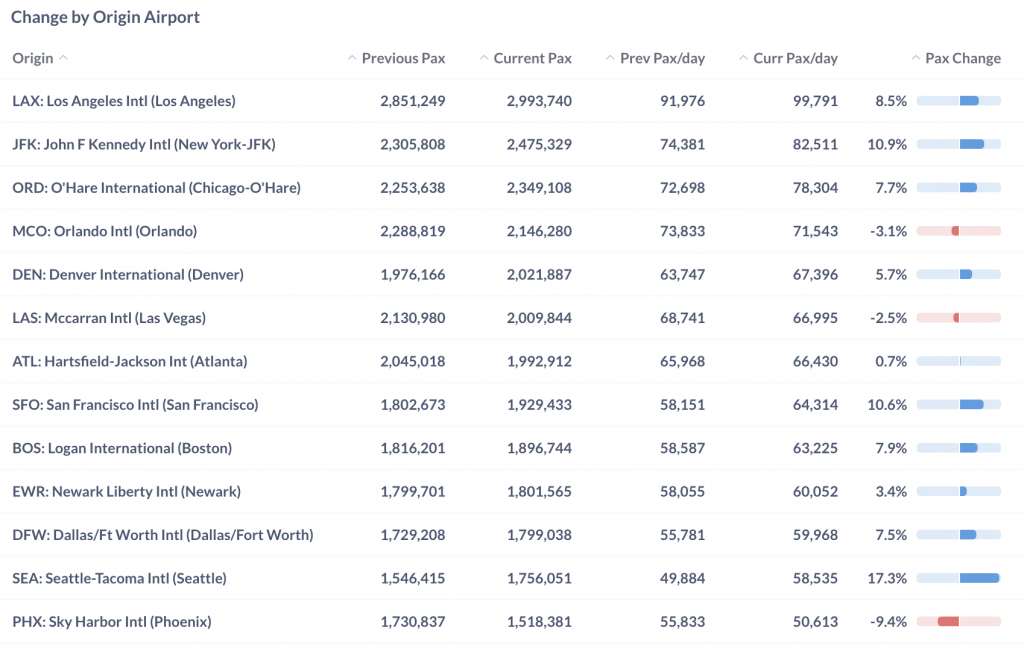

During that period, traffic increased at most major airports. Seattle (SEA), New York (JFK) and San Francisco (SFO) led with month-to-month growth rates of 17.3%, 10.9%, and 10.6%, respectively. However, Phoenix (PHX), Las Vegas (LAS) and Orlando (MCO) experienced some slowdown compared to the previous month.

Figure 5: Air Traffic by Top Origin Airports in May 2024 (Previous) vs. June 2024 (Current)

Year Over Year Comparison

Comparing June 2023 to June 2024, all major US airlines showed growth. Low-cost carrier Frontier (F9), Allegiant Air (G4), and Spirit (NK) led this upward trend with growth rates of 41.2%, 18.8%, and 18.5%, respectively, underscoring their significant contributions to the industry’s positive momentum.

Figure 6: Air Traffic by Dominant Marketing Airlines in June 2024 (Current) vs. June 2023 (Previous)

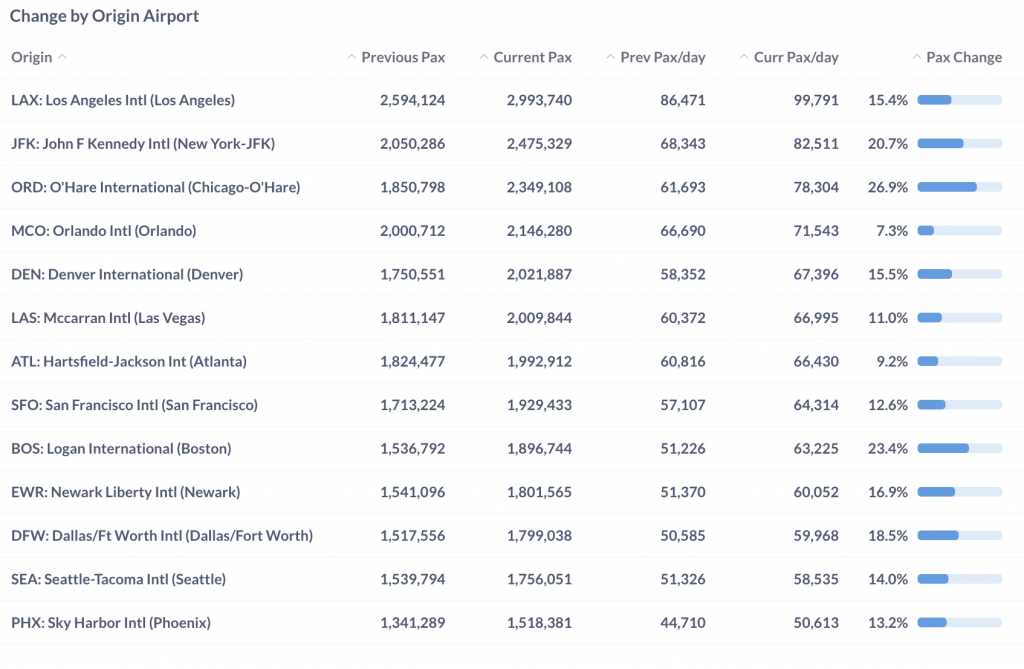

From June 2023 to June 2024, all major airports saw increased traffic. Chicago (ORD), Boston (BOS), and New York (JFK) led this year-over-year growth with substantial expansions, showing traffic increases of 26.9%, 23.4%, and 20.7%, respectively.

Figure 7: Air Traffic by Top Origin Airport in June 2024 (Current) vs. June 2023 (Previous)

For more detailed information on traffic and fares by route and airline, please contact service@flightbi.com or request a demo of Fligence USOD. They will be able to provide you with customized information to meet your specific needs and requirements.