Traffic and fare data by airline and route can provide valuable insights into market trends, demand, and competition. By analyzing this data, airlines can optimize their pricing strategies, plan their capacity, and make informed decisions about their route network. The data can also be used for market and competitive analysis, helping airlines identify profitable routes and gain a competitive advantage.

According to initial true O&D level data from FlightBI released this week, total U.S. domestic air travel declined in August 2025. International travel volumes also saw an slow-down. Additional, average airfares increased during the same period.

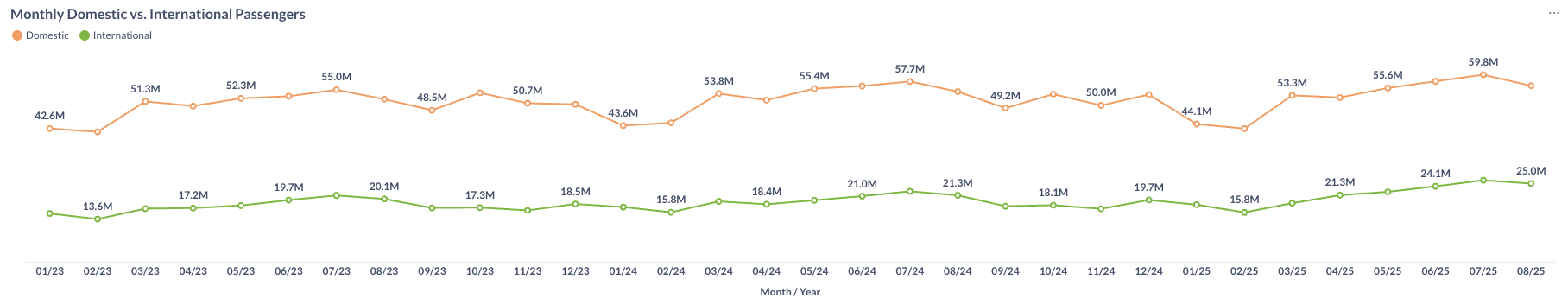

Volume Trend

In August 2025, U.S. domestic passenger traffic decreased to 56.3 million, down from 59.8 million in July and 3.3% higher than August 2024’s 54.5 million. International passenger volumes also dropped, decreasing from 26.1 million in July to 25.0 million in August.

Figure 1: US Domestic and International Air Traffic by Month

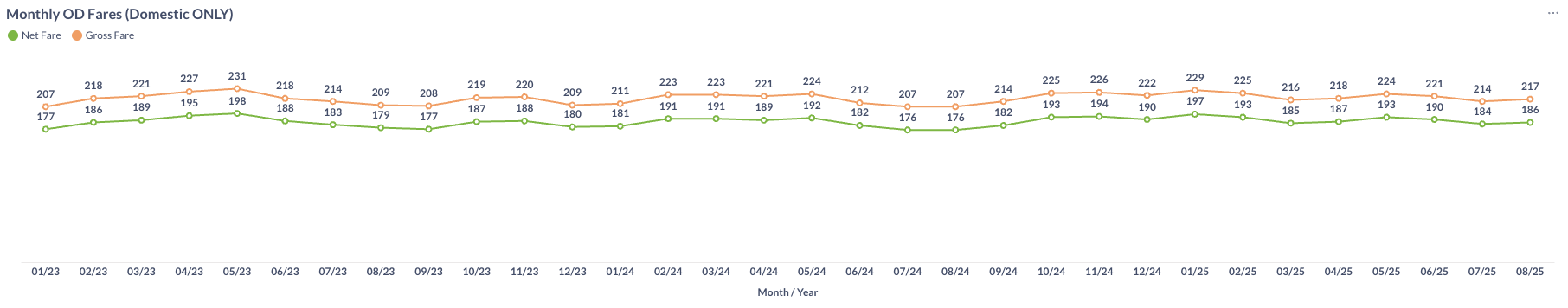

Airfare Trend

Airfares rose in August 2025, with the average gross fare increasing from $214 in July to $217, and the average net fare increasing from $184 to $186.

Figure 2: US Domestic Average Airfare by Month

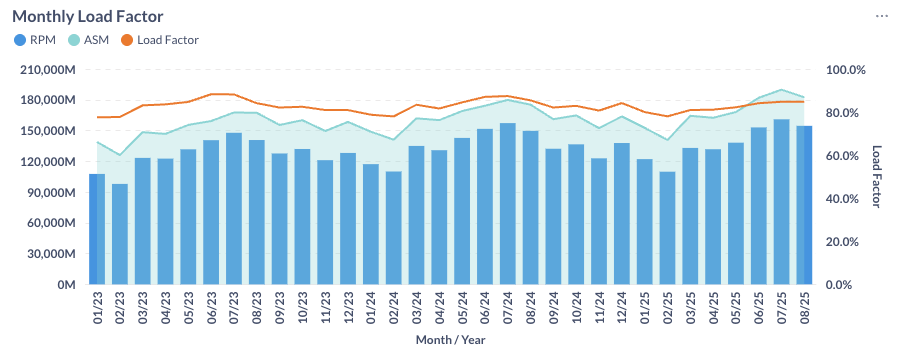

Load Factor Trend

In August 2025, both Available Seat Miles (ASM) and Revenue Passenger Miles (RPM) declined month over month. The average load factor for major U.S. airlines remains at 84.8%, which is below the 85.4% recorded in August 2024 (see Figure 3).

Figure 3: US Airlines’ Average Load Factor by Month

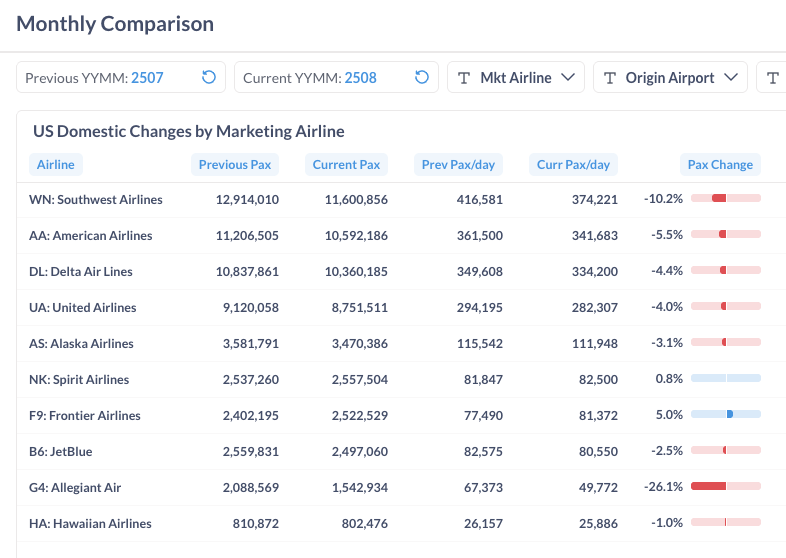

Month Over Month Comparison

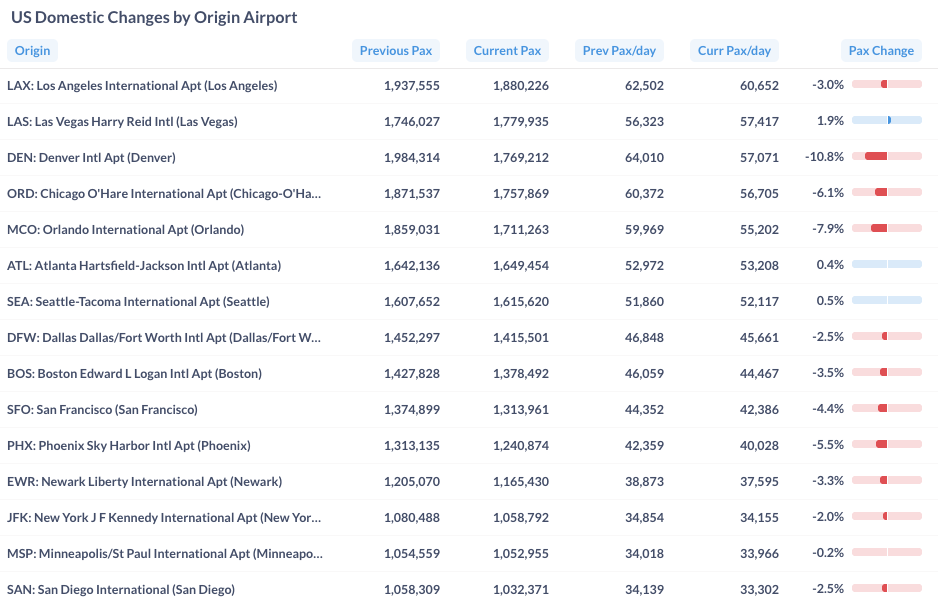

In August 2025, most U.S. airlines recorded lower daily domestic traffic compared to July. Allegiant (G4) led the decline with a 26.1% decrease, followed by Southwest (WN) at 10.2%.

Figure 4: Domestic Air Traffic by Marketing Airlines in July 2025 (Previous) vs. August 2025 (Current)

Most airports reported passenger decline in August 2025. Denver (DEN), Orlando (MCO), and Chicago (ORD) led declines of 10.8%, 7.9%, and 6.1%, respectively.

Figure 5: Domestic Air Traffic by Top Airports in July 2025 (Previous) vs. August 2025 (Current)

Year Over Year Comparison

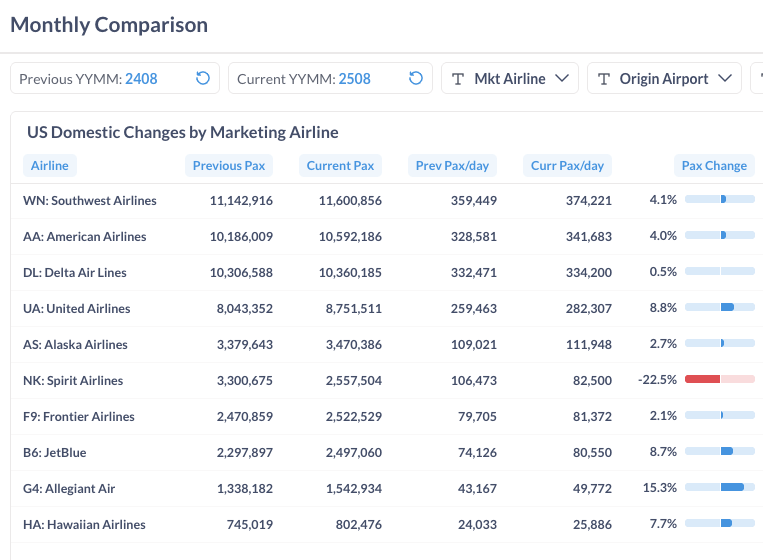

From August 2024 to August 2025, all airlines except Spirit (NK) posted year-over-year growth, led by Allegiant Air (G4) at 15.3% and Hawaiian Airlines (HA) at 7.7%. In contrast, Spirit Airlines (NK) continued its decline with traffic down 22.5%.

Figure 6: Domestic Air Traffic by Marketing Airlines in August 2025 (Current) vs. August 2024 (Previous)

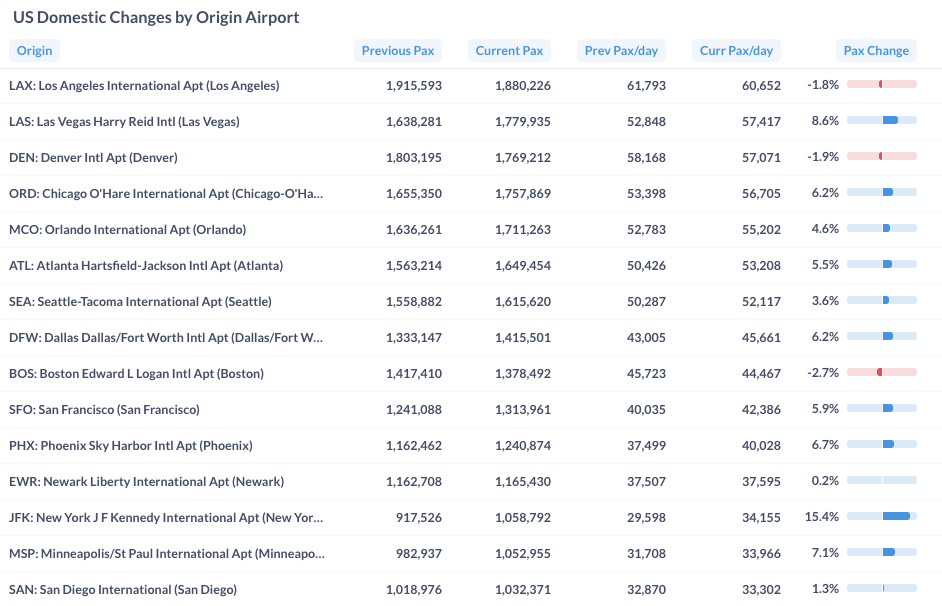

From August 2024 to August 2025, more major U.S. airports experienced increases in domestic traffic than declines. John F. Kennedy International Airport (JFK) and Las Vegas (LAS) led with growth of 15.4% and 8.6%, respectively, while Boston (BOS) and Denver (DEN) posted declines of 2.7% and 1.9%.

Figure 7: Domestic Air Traffic by Top Origin Airport in August 2025 (Current) vs. August 2024 (Previous)

For more detailed information on traffic and fares by route and airline, please contact service@flightbi.com or request a demo of Fligence USOD. They will be able to provide you with customized information to meet your specific needs and requirements.