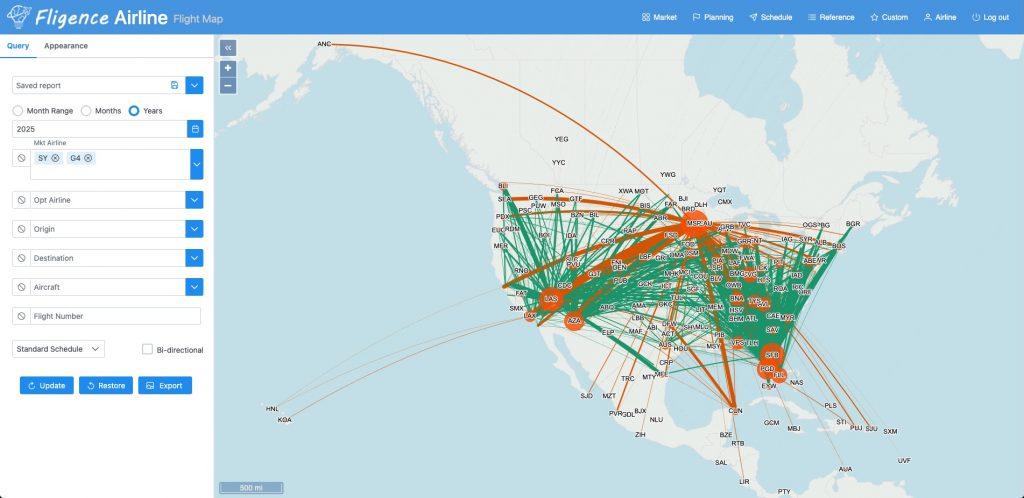

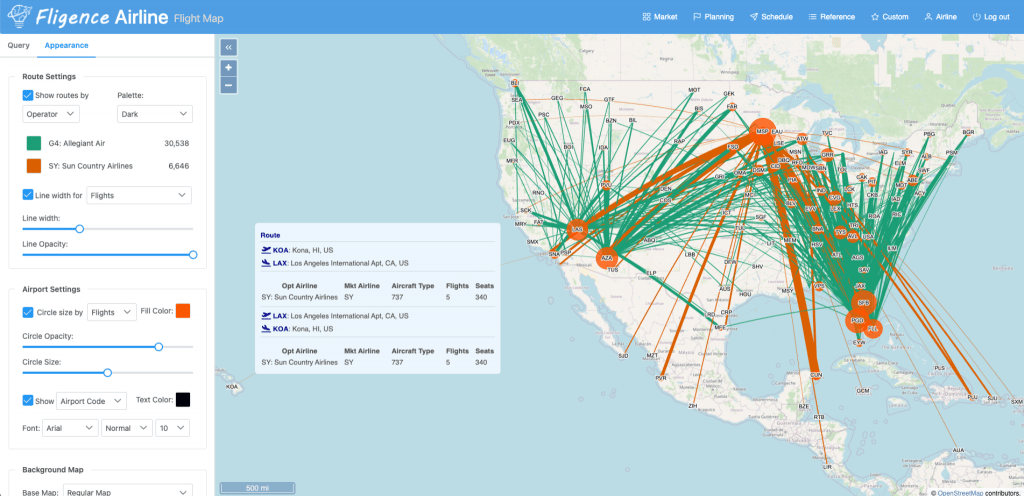

With Allegiant Air announcing a $1.5B merger with Sun Country Airlines, the combined route map tells a powerful story.

Using January–March 2016 schedules, this merged network highlights how complementary—not overlapping— these two airlines really are:

🔹 Allegiant

• Strong point-to-point leisure focus

• Deep coverage of small and mid-size U.S. markets

• Heavy connectivity to Florida, the Southwest, and secondary airports

🔹 Sun Country

• MSP-centric network with broader Midwest reach

• Longer-haul leisure routes, including Hawaii and major coastal cities

• Higher aircraft utilization on denser city pairs

Why this combination works

- Minimal route overlap → limited cannibalization

- Expanded national leisure footprint without major hub conflicts

- Strong balance between ultra-low-frequency leisure flying and higher-density seasonal routes

- Greater flexibility to optimize aircraft deployment and grow underserved markets

Visually, the merged map shows a dense web of leisure connectivity across the U.S., anchored by MSP, Florida, and the Southwest—positioning the combined airline as a scaled leisure powerhouse rather than a traditional hub-and-spoke carrier.

This is a reminder that in airline M&A, network fit matters more than size alone.

Curious to hear thoughts from others in air service development and network planning—what markets do you think benefit most from this combination?