When international visitors travel to the United States, one of their most telling decisions is where they stay — in a hotel, or in the home of relatives or friends. That simple choice reflects travel purpose, income, cultural norms, and the depth of personal connections with U.S. residents.

Drawing on the Survey of International Air Travelers (SIAT) — the U.S. Department of Commerce’s largest ongoing study of inbound air travel — we can see how accommodation patterns have evolved from 2019 through 2025 and how they differ dramatically by region and country of origin.

📈 Long-Term Trend: A Strong Recovery in Hotel Use Post-Pandemic

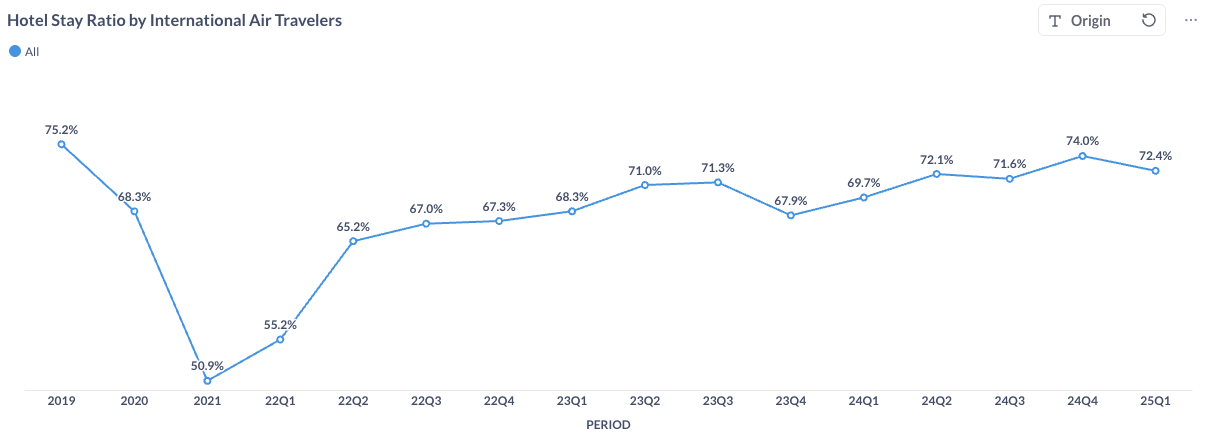

SIAT data show that the share of international visitors using hotels or motels as their main accommodation plummeted to 50.9% in 2021, reflecting pandemic-era restrictions and widespread reliance on relatives’ homes during border closures.

But since 2022, the hotel stay ratio has rebounded sharply, climbing from 55.2% in early 2022 to 72.4% by Q1 2025. This rebound underscores two major shifts:

- Return of discretionary travel: As leisure and business trips resumed, hotels regained their dominant role in the visitor economy.

- Gradual normalization of travel purpose: The early pandemic spike in VFR (visiting friends and relatives) has leveled off as tourists, students, and professionals returned to hotels.

By late 2024, the ratio almost reached pre-pandemic averages, showing how hotels have reclaimed their importance in the international visitor experience.

🌏 Regional Differences: Cultural and Economic Factors at Play

Not all travelers behave alike. SIAT’s 2024 regional breakdown reveals striking contrasts:

| Hotel Stay Ratio by Origin Region | Key Insights |

|---|---|

| Oceania (79.9%) | Highest globally. Visitors from Australia and New Zealand tend to take longer, costlier leisure trips with limited U.S. family networks — making hotels the clear default. |

| Asia (78.2%) | Reliance on hotels by Asian visitors varies (see country break-down). But the overall average is driven by several countries with high income levels and city life habits. |

| Europe (74.1%) | With most visitors coming for leisure and business; well-developed hotel loyalty patterns. |

| North America (73.6%) | Reflects Canada and Mexico air arrivals — most prefer paid lodging, though many also have U.S. relatives. |

| Middle East (65.1%) & Africa (55.1%) | Mixed motives; visitors may combine family visits with tourism or education. |

| Caribbean (46.4%) & Central America (51.7%) | Lowest hotel usage, highlighting deep diaspora networks and high VFR proportions — many stay with family or friends. |

The takeaway: Hotel reliance correlates with distance, income, and diaspora presence — regions with stronger family connections to the U.S. (e.g., Caribbean, Central America) show far more stays with relatives and friends.

🌍 Country-Level Patterns: Who Books Hotels, and Who Stays with Family?

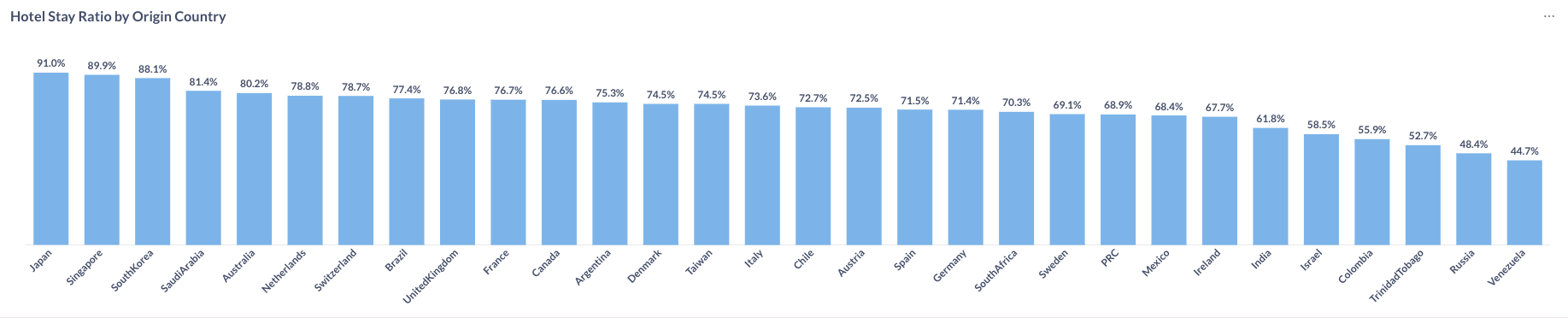

Country-level SIAT data add another layer of nuance.

- Highest hotel usage:

- Japan (91.0%), Singapore (89.9%), and South Korea (88.1%) lead the world. These markets are dominated by business and luxury leisure travel, with strong preference for branded hotels and less reliance on personal networks.

- Saudi Arabia (81.4%) and Australia (80.2%) follow similar patterns, driven by long-haul, high-spend travel.

- Moderate usage (70–78%):

- Visitors from Europe — such as the Netherlands (78.8%), UK (76.8%), France (76.7%), Italy (73.6%) — maintain steady hotel usage typical of long-haul leisure trips.

- Lower usage (<60%):

- India (61.8%), Israel (58.5%), Colombia (55.9%), and Trinidad & Tobago (52.7%) — where family networks and VFR motivations are strong.

- Russia (48.4%) and Venezuela (44.7%) mark the lowest shares, reflecting significant diaspora-driven travel.

These patterns affirm a clear relationship:

The more family and cultural ties a country’s residents have in the U.S., the lower the hotel stay ratio.

Conversely, markets dominated by first-time or short-term leisure visitors favor hotels overwhelmingly.

✈️ Implications for Airport Air Service Development and U.S. Destination Tourism

The SIAT data on hotel versus home stays reveal more than lodging preferences — they directly inform how airports and destinations can shape their route development and marketing strategies.

1. Airports Can Use Lodging Ratios to Gauge Market Strength

- A high hotel stay ratio (e.g., Japan, Singapore, Australia) signals strong tourism and business demand, making these markets prime candidates for new or upgraded nonstop services to major U.S. gateways.

- Conversely, low hotel stay ratios (e.g., Caribbean, Central America) reflect heavy VFR traffic, which sustains consistent year-round travel but at lower yields — ideal for low-cost or seasonal carriers.

- Understanding which markets lean toward hotel-based vs. VFR-based travel helps airports balance profitability and connectivity in their network planning.

2. VFR Markets Drive Resilience

- During downturns (like 2020–2021), VFR travel recovered faster than leisure or business segments because of family and community ties.

- Airports serving regions with large diaspora populations (e.g., Florida, Texas, California, New York) benefit from stable baseline demand, even when international tourism drops.

3. Destination Marketing Should Reflect Lodging Behavior

- DMOs (Destination Marketing Organizations) can tailor outreach:

- Hotel-heavy markets respond to traditional tourism campaigns, package deals, and high-value experiences.

- VFR-heavy markets benefit from community-based messaging — encouraging visitors to extend stays, explore beyond family homes, or combine their visit with local sightseeing.

- Highlighting regional attractions near relatives’ homes can convert informal VFR trips into economic tourism wins for smaller U.S. cities.

4. Collaboration Between Airports, Hotels, and DMOs

- Integrating SIAT lodging data into ASD strategies helps align aviation demand forecasts with tourism infrastructure.

- For example:

- High hotel ratios → airports can pitch new long-haul leisure routes to carriers using tourism-based demand forecasts.

- Low hotel ratios → DMOs and hotels can collaborate to capture spillover nights (e.g., one or two nights at arrival/departure before staying with family).

5. Long-Term Planning and Data Integration

- Lodging patterns provide an indirect measure of spending behavior and trip purpose composition by origin market.

- ASD teams can use this insight to prioritize:

- Revenue-yielding routes from high hotel-ratio countries

- Resilient community routes from strong diaspora markets

- Combining SIAT data with TSA throughput, ticketing data, and hotel stay statistics creates a fuller picture of post-pandemic demand.

🧭 Strategic Takeaway

For airports and destinations, hotel stay ratios are more than a hospitality metric — they’re a demand signal.

Understanding which international visitors stay in hotels versus homes allows:

- Airports to design route portfolios that balance yield and resilience

- DMOs to tailor marketing for both leisure tourists and diaspora-driven VFR travelers

- Communities to recognize how family ties sustain the flow of visitors even when tourism demand softens

In essence, the relationship between air service and lodging choice is a two-way street: flights bring visitors, but where they sleep tells us why they came — and how destinations can best serve them.